About Mandalore Partners & Venture Capital-as-as-Service

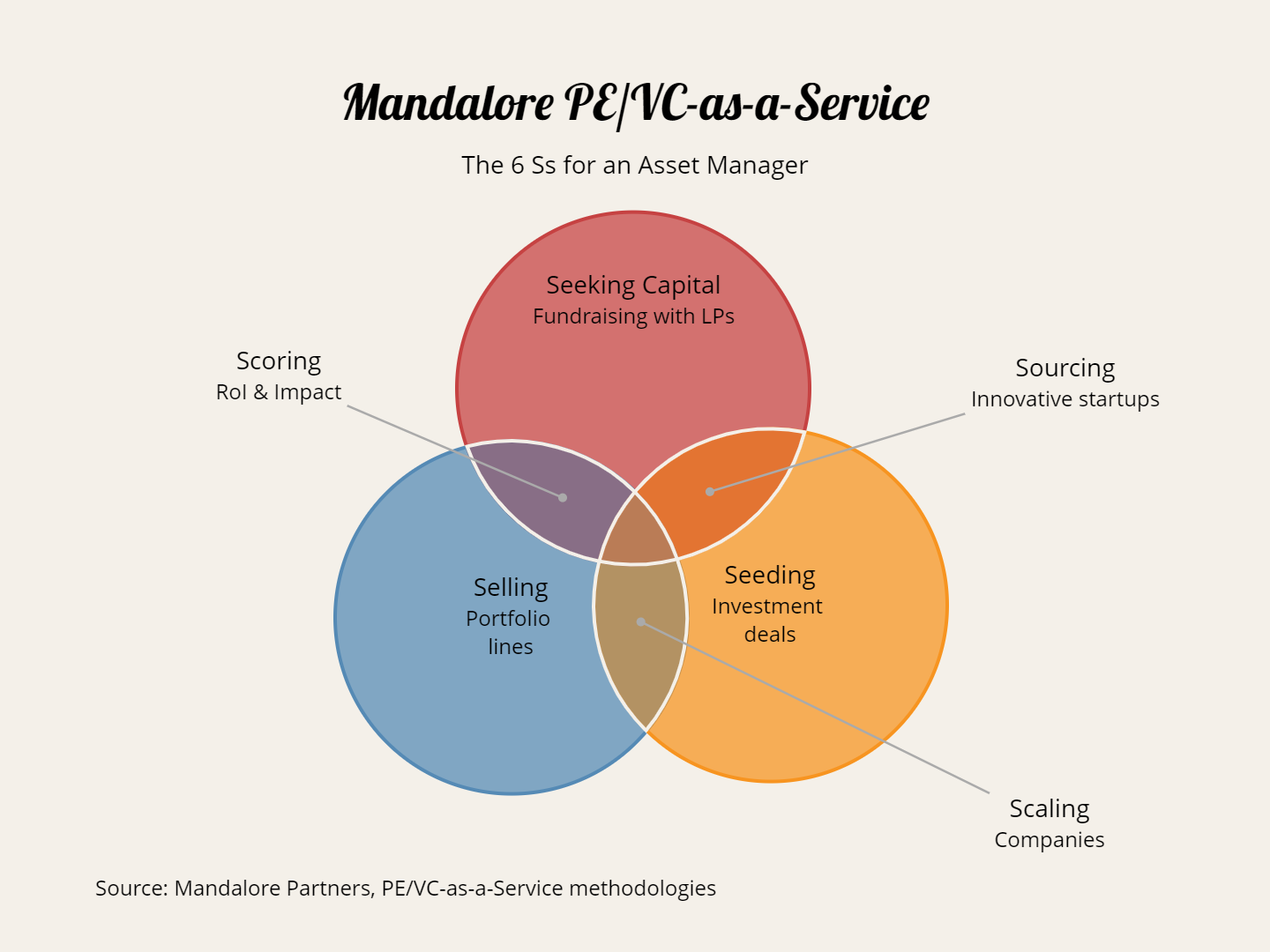

Mandalore Partners specialises in (Corporate) Venture Capital-as-a-service. As an asset-builder for corporations and mid-sized companies, we de-risk innovation with strategic and impact investments by sourcing, investing, and partnering in innovative technology companies fitting our partners’ venture programs.

Mandalore Partners helps customers source startups that are utilizing innovative technologies to access new alternative asset classes. We enable investors to invest in direct equity investments, as well as to co-create alternative funds. Mandalore Partners thereby provides access to new pools of assets being created to support emerging businesses thanks to Corporate VC as a service. Examples include covered bonds, insurance-linked securities, and private debt, among others.

Besides investing, Mandalore Partners also co-develops build-up strategies with portfolio companies to accelerate their scalability and to create business synergies for tech integrations and consolidations.

Mandalore Partners: Pioneering Corporate Venture Capital-as-a-Service

In a world where innovation is the key to staying ahead, Mandalore Partners is a game-changer in the realm of Corporate Venture Capital. We don't just invest in technology, we're redefining how corporations and mid-sized companies innovate. By strategically sourcing, investing, and partnering with groundbreaking technology startups, we tailor our services to fit our partners' unique venture programs.

Bridging Gaps, Building Futures

Our expertise lies in identifying startups that are not just innovative but revolutionary. These startups are pioneering new alternative asset classes, from covered bonds and insurance-linked securities to private debt. We empower investors with opportunities for direct equity investments and co-creation of alternative funds, opening doors to untapped pools of assets that bolster emerging businesses.

More Than Investment

Investment is just the beginning. At Mandalore Partners, we collaborate closely with our portfolio companies, crafting build-up strategies to amplify their scalability. Our focus extends beyond growth; we strive to create symbiotic business relationships, integrating cutting-edge technologies and fostering industry consolidations.

Our Journey

Founded in 2010, Mandalore Partners is a testament to visionary thinking in venture capital. Operating from our hubs in Paris, London, Boston and Luxembourg, we've become a trusted partner for insurance companies, institutional investors, and fund managers. Our strength lies in scaling real and alternative assets, with a keen eye to startups poised to disrupt sectors like InsurTech, InvestTech, ImpactTech and IndustryTech (4i).

Discover Our Story

Delve deeper into our world on BFM Business. Watch Minh Q. Tran, our CEO and Founder, as he unveils the intricacies of Corporate VC-as-a-service. Experience how Mandalore Partners is shaping the future of investment.

Join Our Journey

Stay updated with Mandalore Partners's innovation in venture capital. Follow us, engage with our journey, and be part of a community that's reshaping the business landscape.