Insurtech Capital

Investir dans les technologies de rupture autour de l’épargne en France

-

Insurtech Capital investit dans les technologies de rupture dédiées à l’épargne, en collaboration avec des partenaires industriels de renom tels que Groupe Apicil, Generali, Arkéa-Suravenir, Edmond de Rothschild, Alpheys, Intencial, ainsi que des Conseillers en Gestion de Patrimoine (CGPs).

Après l’investissement, le fonds s’engage activement à développer des opportunités commerciales avec ces partenaires, renforçant ainsi les synergies entre innovation technologique et expertise sectorielle.

-

Le portefeuille est composé de solution innovante autour de InvestTech, de l’EpargneTech and la distribution digitale de produits financiers

-

Le fonds fait de la mesure d’impact sur le bilan carbone de ses lignes suivant la méthodologie Impact Management Project

Portfolio Overview

Insurtech Fund

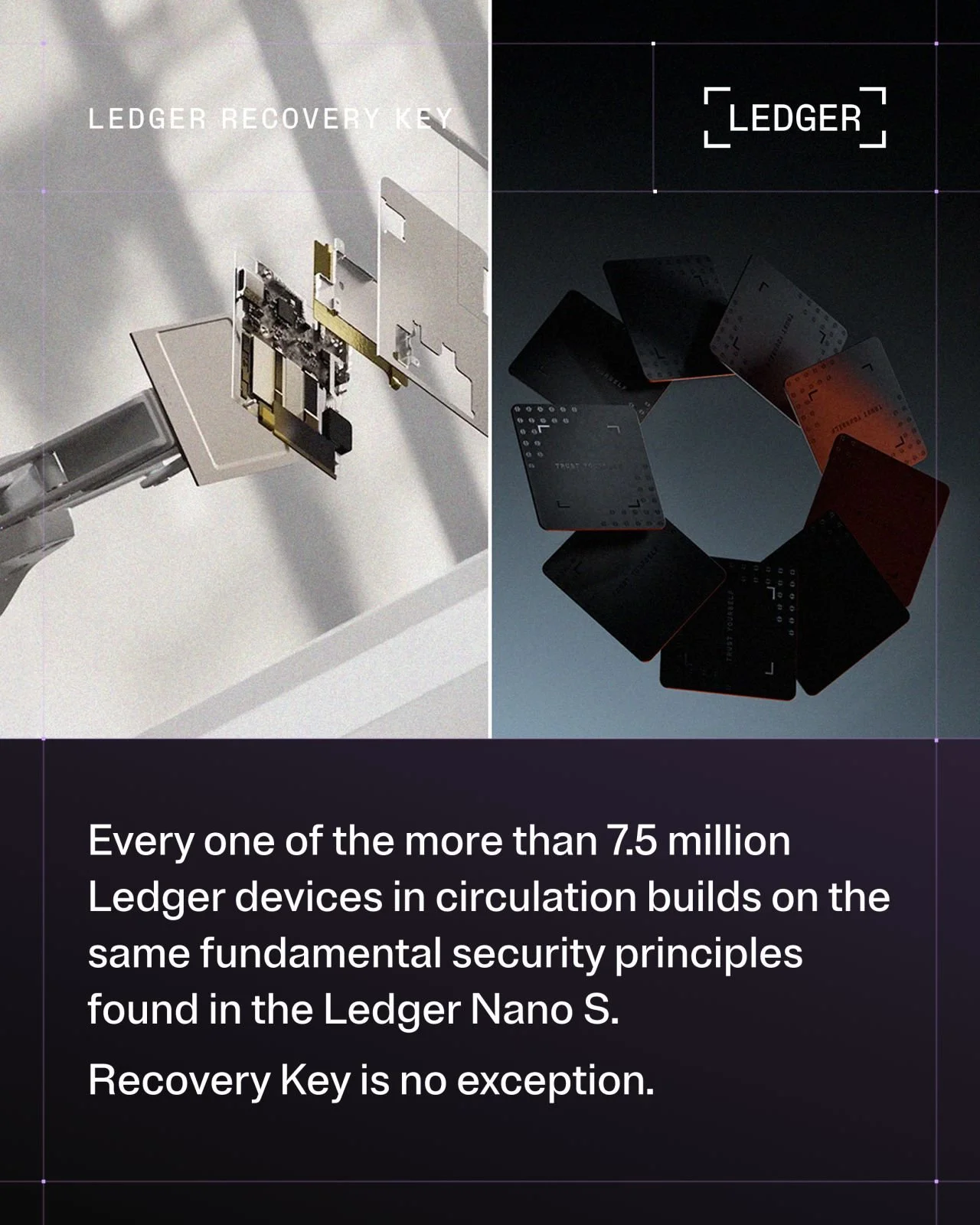

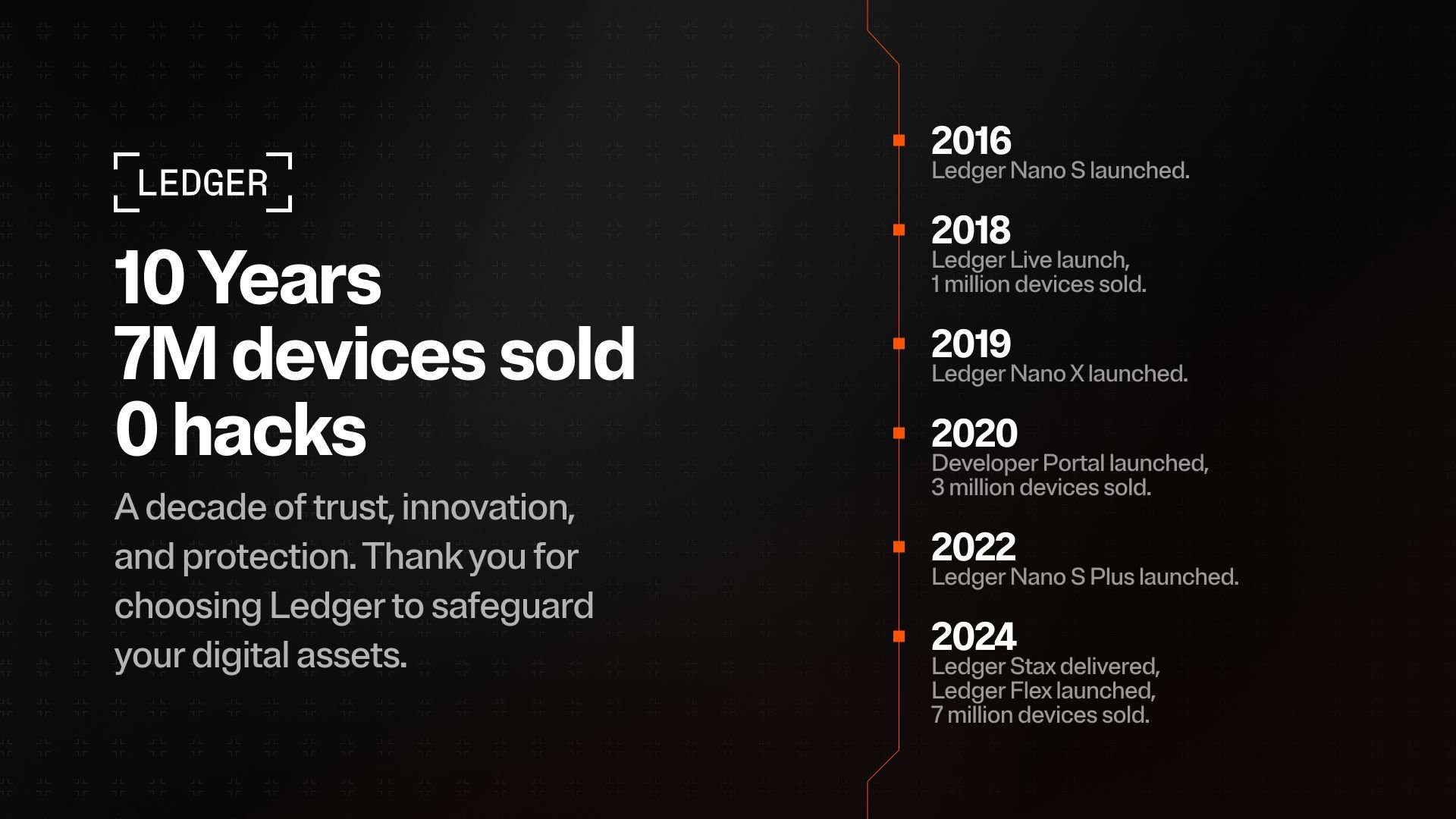

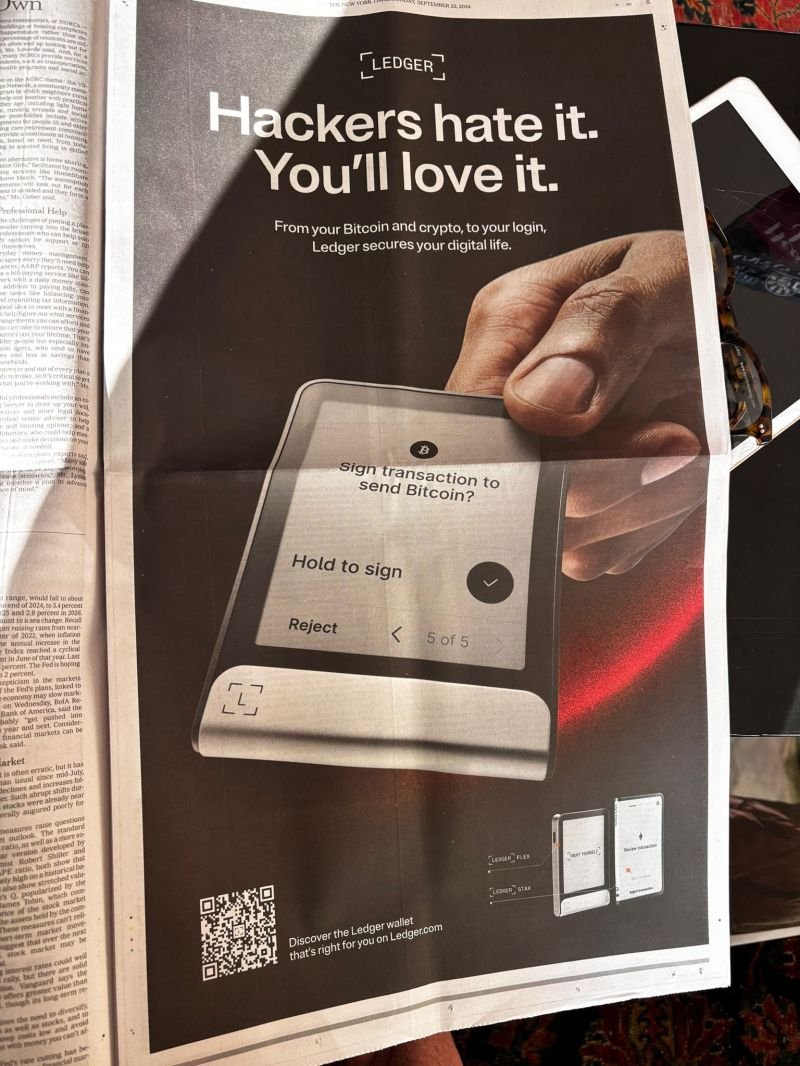

Founded in Paris in 2014, LEDGER is a global platform for digital assets and Web3. Ledger is already the world leader in Critical Digital Asset security and utility. With more than 6M devices sold to consumers in 200 countries and 10+ languages, 100+ financial institutions and brands as customers, 20% of the world’s crypto assets are secured, plus services supporting trading, buying, spending, earning, and NFTs.

In addition to consumer products, Ledger has also developed Ledger Enterprise, a digital asset custody and security solution for institutional investors and financial players.

Pledger is a fintech aimed at democratizing, decentralizing and dematerializing credit guaranteed by financial assets. The technological solution developed by Pledger makes heritage credit accessible to possessing at least 20,000 euros of financial assets.

Created in 2022, Pledger is the result of the association of an intergenerational and expert team, including Renaud Sassi, former CEO of Banque Carrefour, Thomas Breitenstein and Adrien de Forceville, two young polytechnicians.

Nalo is one of the French market leaders in online savings and financial consulting services, and pioneered goal-based savings plans. Since it was founded in 2018, it made it its mission to enable individuals to invest effortlessly and without it being a cause for worry, so that everyone could finance their retirement, real estate investment, inheritance building and any other project.

FundShop was sold to Alpheys Group in March 2022 (see press release).

FundShop delivers digital solutions for savings management and investment advice through white-label applications that automate and personalize portfolio construction and monitoring processes within a controlled regulatory context.

A true pioneer of the Fintech scene in France, FundShop was founded in 2013 around a unique BtoB robo-advisor positioning by focusing its innovation on services and tools, and not on product distribution.

Founded in 2013 by Michel Ivanovsky and Jean-Michel Errera, two former bank executives, Mipise specialises in technological innovation for financial players wishing to engage in their digital transformation. Its "white label end-to-end" solutions enable the digitalisation of complex and critical on-boarding, investment and payment workflows in Private Equity, Wealth Management, Insurance and Corporate fields.

At the heart of the Mipise project, the vision of a finance that must reinvent itself thanks to digital technological tools, Saas platforms, blockchain to enable the success of a collaborative and efficient financial economy.

Headquartered in London, The Hub Exchange Limited (“HUBX”) delivers state-of-the-art deal syndication platforms to help banks, brokers, exchanges and asset management firms execute private transactions within their own network and beyond.

HUBX simplifies collaboration between banks by allowing institutions of all sizes to quickly deploy their own deal syndication platform and share deals on their own terms privately. HUBX delivers its robust, secure platform directly as well as through outsourcers and major industry service providers.

The 1st data management marketplace in Europe, INVYO is a leading publisher-integrator of technological solutions, specialist in data processing and analysis. A unique and adaptable platform with a common and scalable technological base according to your business needs.

Exit in 2024

Ramify is an investment platform that offers wealth management services to individuals: managed investments in life insurance and retirement savings plans, investment in start-ups, SCPI and private equity. Founded in 2020 by Olivier Herbout, ex-portfolio manager at Goldman Sachs and Samy Ouardini, ex-strategy consultant at Oliver Wyman, Ramify aims to make multi-product asset allocation management simple and accessible.

Founded by Thomas Perret and Thibault Jaillon, Mon Petit Placement is a Lyon-based fintech aiming at democratising private management. Based on the observation that the majority of savers are often oriented towards traditional savings products and are poorly informed about financial mechanisms, Mon Petit Placement provides its users with personalised support in their investment strategy through a simple and educational interface and allows them to access high-end financial products previously reserved for wealthy clients.

Mon Petit Placement also offers a range of thematic and responsible investments designed to give meaning to savings. Divided into seven portfolios - Equality, Employment, Climate, Solidarity, Tech, Health and Stimulus - this offer makes it possible to reconcile financial performance and positive impact.

IZNES was born out of the desire to create the first international platform for buying and selling European UCIs in blockchain on behalf of institutional and retail clients, compatible with the different marketing channels. IZNES was created in 2017 by six management companies (Ofi AM, Groupama AM, La Banque Postale AM, Lyxor, Arkéa IS and La Financière de l'échiquier). Thanks to blockchain technology, this solution makes it very simple to buy or sell UCI units directly from the management companies, while offering the highest standard of security.

Axa Seed Factory

In 2009, Anne-Cécile Worms founded Art2M (Art To Machine), a young innovative company specializing in the production and distribution of exclusive or tailor-made digital works of art and connected objects. Since 2014, Art2M has been producing Variation, Media Art Fair, the first exhibition and sale dedicated to the new media contemporary art market in France. Anne-Cécile Worms manages the Makery media (www.makery.info), the media for all labs, recognized as an online press organization.

Here is a map that Makery created to monitor labs around the world:

Founded in May 2015 and based in New York City, One More Company offers the email intelligence services, ContactRescue and Evercontact. Both services are devoted to saving time and improving email communication while ensuring consumer control, privacy, and transparency. Evercontact analyzes email signatures in new incoming emails, then saves (and constantly updates) this valuable contact information right in your address book or CRM. Evercontact also offers ContactRescue which fills in the missing spaces in your address book with detailed contact information for the people you’ve been emailing up to 5 years ago.

Huma is a global digital health technology company that uses AI to advance digital-first care delivery and research to help people live longer, fuller lives.

Huma's regulated Software as a Medical Device is the only disease agnostic platform to hold both EU MDR Class IIb and US FDA Class II regulatory status. It powers :

Digital first care for health systems

Companion apps to support patients through treatment and drug therapies

Virtual clinical trials to accelerate research.