Crowdfunding has become a popular way for individuals and organizations to raise money for a wide range of projects and ventures. A crowdfunding platform, or a crowdfunding site, is a website or online service that facilitates the raising of funds through a crowdfunding campaign. These crowdfunding websites enable individuals and organizations to create a campaign, set a funding goal, and offer rewards or equity to individuals who contribute funds. With the emergence of various types of crowdfunding such as reward-based, donation-based, and equity crowdfunding, more and more people are turning to crowdfunding platforms to raise money for their projects. The ability to reach a global audience and raise funds through a crowdfunding campaign on a crowdfunding site has made it possible for many projects that might have otherwise been unable to find funding, to be realized. Crowdfunding platforms have become an essential tool for entrepreneurs, artists, activists and non-profit organizations.

Types of Crowdfunding

There are several different types of crowdfunding, each with their own unique characteristics and benefits:

Reward-based crowdfunding: This is the most common type of crowdfunding, and it involves offering rewards to people who contribute money to a project. For example, an inventor may offer a prototype of their product to people who pledge a certain amount of money. This type of crowdfunding is popular among entrepreneurs, artists, and creators who are looking to raise funds for a specific project or idea. According to a 2020 report by the World Bank, reward-based crowdfunding accounted for approximately 60% of the global crowdfunding market.

Donation-based crowdfunding: Involves raising money for a cause or charity, with no rewards or perks offered in return. This type of crowdfunding is often used for charitable causes, social impact projects, and humanitarian efforts. For example, a nonprofit organization may use donation-based crowdfunding to raise funds for a disaster relief effort or a community development project. According to the same report, donation-based crowdfunding accounted for approximately 10% of the global crowdfunding market.

Equity-based crowdfunding: Involves selling ownership stakes in a company or project to investors. In this case, the investors will receive a percentage of the company's profits or ownership in the company. This form of crowdfunding is particularly popular among startups and early-stage companies, as it allows them to raise funds and build a community of supporters while giving investors the opportunity to participate in new business opportunities. According to the same report, equity-based crowdfunding accounted for approximately 20% of the global crowdfunding market.

Each type of crowdfunding has its own advantages and disadvantages and it depends on the project and the goals of the project initiators to choose which type of crowdfunding suits them best.

Looking to the future, the industry is expected to continue growing, as more people become aware of the opportunities that crowdfunding offers and as more governments and regulatory bodies create framework to support the industry. Additionally, with the growth of impact investing and socially responsible investing, it is likely that crowdfunding will become an increasingly popular way to raise capital for projects that promote social and environmental causes. Additionally, the proliferation of online platforms and technology advancements will likely make crowdfunding more accessible and efficient, allowing more people to participate and benefit from the opportunities it provides.

However, it's also important to note that the industry will face challenges as well, such as the need for better regulation and oversight to protect investors and ensure that funds are used for the intended purposes. It's also crucial for the industry to ensure that crowdfunding is accessible and inclusive for all, and not just for certain groups of people with privileged access to technology and information.

Popularity of Crowdfunding

Crowdfunding has become increasingly popular in recent years as a way for entrepreneurs, artists, and creators to raise money for their projects. It has also become a way for investors to access early-stage companies and participate in new business opportunities. According to a 2020 report by the World Bank, the global crowdfunding market is expected to grow to more than $300 billion by 2025.

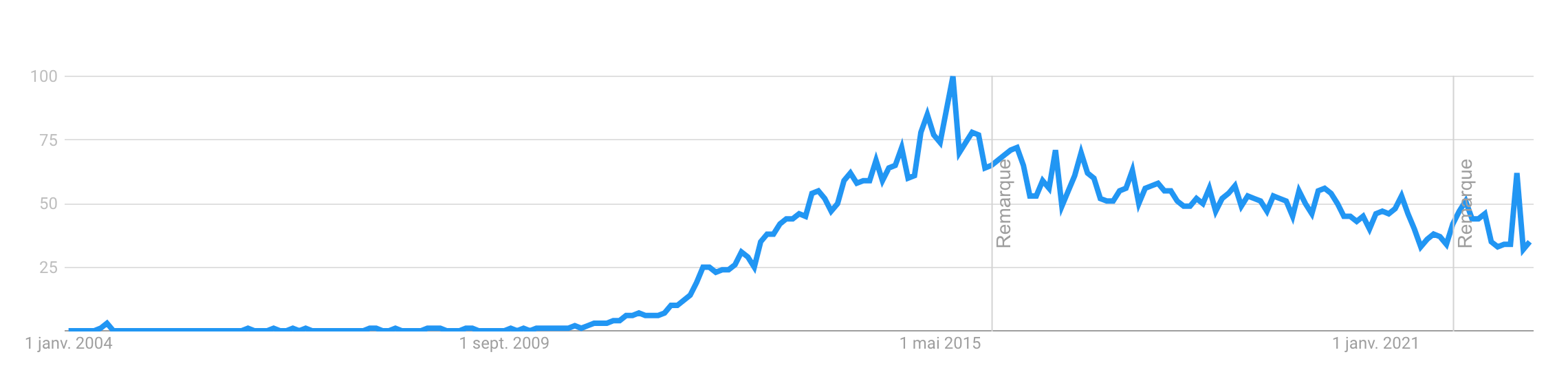

Source: Google Trends

Crowdfunding began to be well known after 2010, and then developed to be used in various different sectors.

Growth of Crowdfunding in France

In France, crowdfunding has seen a steady growth in recent years. The French crowdfunding market reached €1.3 billion in 2019, a growth of +20% compared to 2018. There are different platforms such as Ulule, KissKissBankBank, and Leetchi. These platforms have allowed thousands of French projects to be financed, ranging from creative projects to social and environmental causes.

Government Support for Crowdfunding in France

The French government has also taken steps to support the growth of crowdfunding in the country. In 2019, it introduced a new regulation for equity-based crowdfunding, which aimed to improve the legal and regulatory framework for the industry. The new regulation established a framework for the registration and supervision of crowdfunding platforms, as well as guidelines for the disclosure of information to investors.

Challenges Facing Crowdfunding in France

Lack of understanding of the industry among the general public

Lack of standardization and transparency in the industry

The challenges of crowdfunding are well developed in the article: Le crowdfunding Concepts, réalités et perspectives, published by Olivier Joffre and Donia Trabelsi on Cairn.info

International Market of Crowdfunding

Interest for Crowdfunding by region last year (Source: Google Trends)

The international market of crowdfunding has grown rapidly in recent years, with the market size projected to reach over $300 billion by 2025, according to a 2020 report by the World Bank. The report also estimates that there are over 2,000 crowdfunding platforms operating globally, with the largest markets being in North America and Europe.

North America

North America has traditionally been the largest market for crowdfunding, with the United States being a major player. According to a report by the Cambridge Centre for Alternative Finance, the crowdfunding market in the US was worth $17.2 billion in 2018. The US is home to a large number of crowdfunding platforms, including Kickstarter and Indiegogo, and the country has a well-established legal and regulatory framework for crowdfunding.

Europe

Europe is another major market for crowdfunding, with the United Kingdom, France, and Germany being some of the largest players. According to the same report, the crowdfunding market in the UK was worth $6.2 billion in 2018, while the market in France was worth $1.2 billion and Germany $755 million. Europe is also home to a large number of crowdfunding platforms, such as Crowdcube and Seedrs in the UK, Ulule and Leetchi in France, and Companisto and Seedmatch in Germany.

Asia

Asia is also becoming an increasingly important market for crowdfunding. According to a report by the Cambridge Centre for Alternative Finance, the crowdfunding market in China was worth $2.2 billion in 2018, making it the second-largest market in the world after the US. China is home to a large number of crowdfunding platforms, including JD Finance and Yungroup, and the country has a rapidly growing middle class that is increasingly looking for alternative investment opportunities.

Other countries

Other countries that have seen significant growth in crowdfunding include Australia, Canada, and Singapore. According to the same report, the crowdfunding market in Australia was worth $211 million in 2018, while the market in Canada was worth $150 million and Singapore $64 million. These countries also have a growing number of crowdfunding platforms catering to a diverse range of projects and investors.

It is important to note that the market growth and penetration of crowdfunding can vary in different countries, and is affected by different factors like culture, regulations, technology penetration, investor and entrepreneur's behavior etc. Additionally, the types of crowdfunding that have seen the most success also vary between countries. For example, in the US and UK, equity-based crowdfunding is more popular, while in France and Germany, donation-based crowdfunding is more common. Furthermore, the regulations and laws surrounding crowdfunding can vary significantly between different countries, and it's important for platforms and project initiators to be aware of these differences when operating in different markets.

In conclusion, the international market of crowdfunding is rapidly growing and offers a diversity of options for different types of projects and investors. The growth of the industry is expected to continue in the future, driven by the increasing popularity of alternative forms of investing and the growing number of people who are looking for ways to access new business opportunities and support social and environmental causes. The market growth and the specific types of crowdfunding that are more successful can vary between countries, and it's important for platforms, entrepreneurs, and investors to stay informed of the particularities of the market they operate in.

Comparison of Crowdfunding Regulations

The regulations of crowdfunding vary across different countries, and it is important for platforms and project initiators to be aware of these differences when operating in different markets.

United States

In the United States, the Securities and Exchange Commission (SEC) has established a regulatory framework for crowdfunding under the Jumpstart Our Business Startups (JOBS) Act, passed in 2012. The JOBS Act established two exemptions, Regulation Crowdfunding (Reg CF) and Regulation A+, which allow companies to raise capital from retail investors through crowdfunding portals. Regulation CF permit companies to raise a maximum aggregate amount of $5 million in any 12-month period, with individual investment limits of $2,000 or $5,000. Regulation A+ allows companies to raise up to $75 million in a 12-month period, with no restriction on the amount an individual can invest.

Europe

In Europe, the European Securities and Markets Authority (ESMA) has established a framework for crowdfunding regulation through the Alternative Investment Fund Managers Directive (AIFMD) and the Prospectus Directive. The AIFMD regulates crowdfunding platforms that raise funds from retail investors to invest in alternative investments, while the Prospectus Directive applies to crowdfunding platforms that raise funds through the sale of securities to retail investors. In addition, the directive on markets in crypto-assets (MiCA) applies to some forms of Crowdfunding using crypto-assets in EU.

United Kingdom

In the United Kingdom, the Financial Conduct Authority (FCA) has established a regulatory framework for crowdfunding, including rules on disclosure, investor protection, and the types of projects that can be funded. In accordance with the FCA regulations, crowdfunding platforms are required to conduct due diligence on projects and provide investors with accurate and complete information about the project before they invest.

France

In France, the Autorité des marchés financiers (AMF) has introduced a regulatory framework for equity-based crowdfunding in 2019. The new regulation established a framework for the registration and supervision of crowdfunding platforms, as well as guidelines for the disclosure of information to investors.

China

In China, the National Development and Reform Commission (NDRC) and the People's Bank of China (PBOC) issued a guideline for the regulation of crowdfunding platforms in 2016. According to the guidelines, platforms are required to obtain a license from the NDRC and meet certain requirements such as providing clear information about projects and protecting investor interests.

Singapore

In Singapore, the Monetary Authority of Singapore (MAS) has issued a regulatory framework for crowdfunding platforms in 2015, which includes the requirement of platforms to be registered and regulated by the MAS, and it also sets rules around the disclosure of information to investors.

It's worth noting that regulations can change over time and can vary between different regions, so it's important to keep track of any updates or changes that may occur. It's also important for platforms and project initiators to consult with legal and compliance experts to ensure that they are aware of and compliant with all relevant regulations in the country or region where they operate. These regulations are put in place to protect investors and ensure that the funds raised through crowdfunding are used for their intended purposes, so it's important for everyone involved in the process to be aware of and adhere to them.

Furthermore, it's important to mention that not only the regulations are important but also the actual compliance with them by the platforms, as it's crucial that they conduct the due diligence, provide the appropriate disclosure and manage the funds with transparency. This will foster trust among investors and will encourage more people to participate and invest in crowdfunding campaigns.

In summary, the regulations and laws surrounding crowdfunding can vary significantly between different countries, and it's important for platforms and project initiators to be aware of these differences when operating in different markets. It's important to stay up-to-date with any changes or updates to regulations, and to consult with legal and compliance experts to ensure compliance with all relevant regulations. Additionally, it's essential for all parties involved to comply with these regulations to ensure the protection of investors and the proper use of funds raised through crowdfunding.

Conclusion

In conclusion, crowdfunding has grown rapidly in recent years as a method of raising capital for projects and ventures. It offers several different types of funding options, such as reward-based, donation-based, and equity-based crowdfunding, each with its own unique characteristics and benefits. The global crowdfunding market was worth approximately $16 billion in 2015 and is expected to reach more than $300 billion by 2025. The largest markets for crowdfunding are in North America and Europe, with the United States, the United Kingdom, France, and Germany being some of the major players. Additionally, Asia is also becoming an increasingly important market for crowdfunding, with China being the second-largest market in the world after the US.

However, despite the opportunities that crowdfunding offers, it's important for the industry to keep evolving in a responsible and sustainable way, ensuring the protection of all stakeholders' interests. The regulations and laws surrounding crowdfunding can vary significantly between different countries, and it's essential for platforms and project initiators to be aware of these differences when operating in different markets. The growth of the industry is expected to continue in the future, driven by the increasing popularity of alternative forms of investing and the growing number of people who are looking for ways to access new business opportunities and support social and environmental causes. As the market continues to grow and evolve, it will be important for governments, regulatory bodies, and industry organizations to work together to ensure that crowdfunding is accessible, safe, and inclusive for all stakeholders.