1. Frameworks for Corporate VC as a Service

Why do corporations need Corporate VC-as-a-Service ?

What is the Bell Mason framework for Corporate VC as a Service ?

2. Business case : how to implement the Bell Mason framework ?

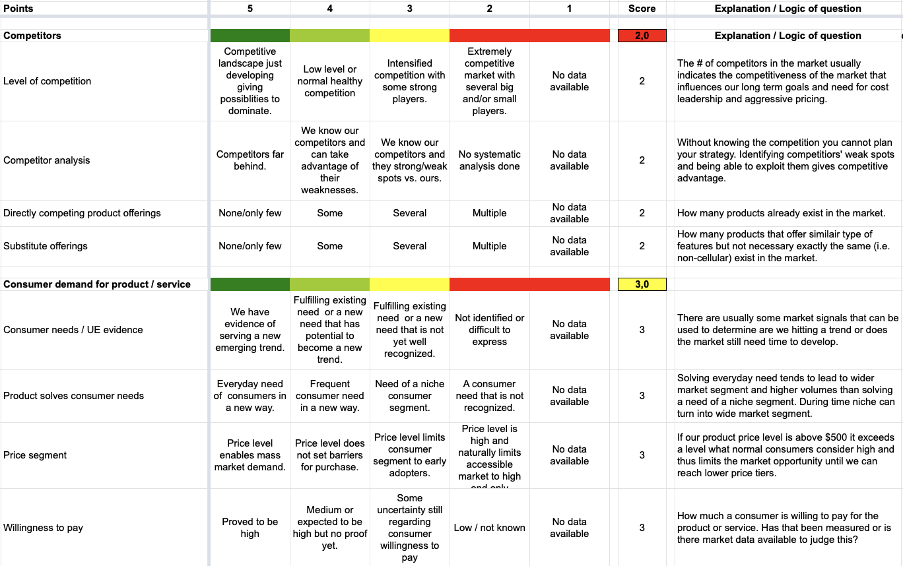

“Competitive advantage” scoring

3. Mandalore Partners’ is adding a new criteria to the Bell mason model : impact

Frameworks for Corporate VC as a Service

A. Why do corporations need Corporate VC-as-a-Service ?

Corporations need to create an environment that allows innovation in order to keep up with the competition, but also need to provide enough structure to control risk. As a result, Corporate Venture Capital is a key to the strategic development of any corporation. Corporate VC can be outsourced to a VC fund which will source startups, elaborate the due diligence, and manage the portfolio. This is called “Corporate VC as a Service''.

Corporate VC-as-a-Service can help Businesses to create a digital ecosystem, enabling synergies within the Corporate portfolio while minimizing the risk.

In Venture imperative : a new model for corporate innovation, Heidi MASON and Tim ROHNER explain that corporate venturing is the best way to successfully test and launch innovative corporate growth strategies.

Mason and Rohner describe how the Bell-Mason Diagnostic - an objective, multi-dimensional examination and scoring system - can be used as an assessment tool to measure and guide successful corporate venturing.

B. What is the Bell Mason framework for Corporate VC as a Service ?

The Bell Mason Framework for Corporate Venture Development describes the 5 Phase stages a startup is going through. The goal is to adapt the analysis of a startup according to its stage. Unlike traditional product development processes, this Framework describes best practice requirements by stage for the entire venture business, not only for the product.

VC funds like Mandalore Partners can offer Corporate VC-as-a-Service to companies which seek to invest in startups but do not want to bear the risk. Mandalore Partners and other VC as a Service implement their investment after a scoring methodology, like the one described in the Bell Mason Model.

The five stages of a venture growth over time :

- Concept : idea, competitive landscape

- Seed : business model, core team, research

- Alpha : pricing, product pilote

- Beta : validated business plan, first commercial launch

- Market calibration : proven revenue model, roadmap, segment expansion, full team

The four dimensions a VC should analyze for each stage : Product, Market, Finance, People.

Successful business growth

According to the Bell-Mason graph, according to its stage, a new venture show different “score” for each of the 12 dimensions.

2. Business case : how to implement the Bell Mason framework ?

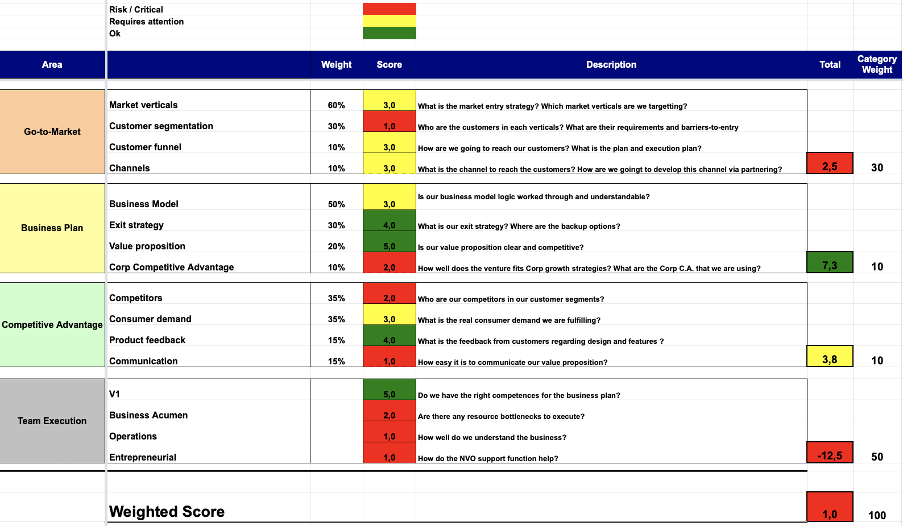

A. Global view

Four milestones

There are four milestones, each of which contains 4 criteria.

Rating

For each of the four milestones criterias, we will use a scoring. The scoring will follow the following process:

Example from Mandalore Partners :

The VC as a Service company will assess the startup following a rating of each criteria. It will give a final weighted score to the application of the startup, enabling to make a decision regarding the fact to implement the investment or not.

B. “Go to market” scoring

Here is a break down of the issue tree :

Then, we apply a grading system :

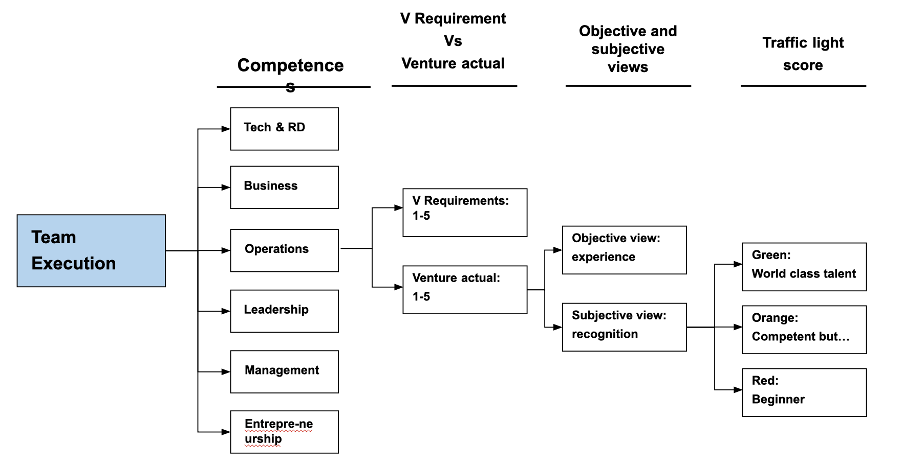

C. “Team” scoring

D. “Competitive advantage” scoring

E. “Business Model” scoring

3. Mandalore Partners’ is adding a new criteria to the Bell mason model : impact

As a Corporate VC-a-a-Service, Mandalore Partners is adding some criterias to the classic Bell Mason framework : impact. Mandalore Partners is assessing impact through the following method, with the help of its partner Impact Track.

Mandalore Partners recognises the increasing added value of moving beyond Environmental, Governance and Social (ESG) Criteria and seeks to partner with investors that aim to optimise financial, social and environmental returns via impact investing. Hence, Mandalore Partners can help corporations to use corporate VC as a tool to progress regarding ESG criterias.

Mandalore Partners has developed its proprietary Diamond Impact Scoring Scheme, an impact scoring system that allows not only to evaluate potential investments through the impact lens but also to monitor the impacts of the portfolio companies.

Diamond Impact Scoring Scheme provides a 4-dimensional analysis of both anticipated impact risks and returns, thus it is more complete than ESG analyses that usually only account for minimizing negative impacts, or risks.

Reliable tool for screening and qualifying the impact performance, it also provides a visual framework that helps to disclose the results in an easily digestible format to the stakeholders.

Diamond Impact Scoring Scheme incorporates both Impact Management Project (IMP) methodology, aligns to SDGs and weighs ESG criteria in the 4 following dimensions:

Anticipated Outcomes. This dimension is rated based on the findings of the overall assessment of the company’s expected impacts, using the IMP methodology.

Industry Leadership. This dimension is rated based on the findings of the customized ESG risk/impact profile of the company. It assesses the capacity of the company to be exemplary in managing its impacts on key stakeholders to protect and enhance value.

Investment Added Value. This dimension evaluates the potential added-value of investing in the company. The idea is to assess how the investment will contribute to the course, scale and depth of the generated impact and underlying business.

Alignment. This dimension assesses how effectively the company’s positive impacts align with financial returns.