Venture capital (VC) is a form of investment for early-stage, innovative businesses with strong growth potential. Often led by funds, Venture Capital investments are not for the faint of heart.

However, VC investments can be a fully outsourced service build new, in-house VC capabilities for Corporations, family offices or Business Angels. Known as VC-as-a-Service, the demand for such a service is booming.

Why ?

Corporate venture capital (CVC) is the investment of corporate funds directly in external startup companies.

CVC is beneficial for corporations for two aspects:

From a strategic point of view, CVC represents a true external source of innovation and enables an active monitoring of the sector’s future evolutions for corporations. CVC is also allowing corporations to attract the best profiles willing to work in a dynamic environment.

From a financial perspective, CVC often leads to return on investment. As for classical VC investment, CVC investments are generally characterized as very high-risk/high-return opportunities.

CVC is also a great opportunity for start-ups. More than getting only financial resources like with VC funds, they can get the optimal mix of capital and business value from the corporations. Indeed, start-ups have access to the fund’s financial expertise but also to the corporations’ knowledge about the sector.

Thus, CVC is a win-win solution for both corporations and start-ups. However, this solution is hard to implement in real life.

Indeed, VC abilities requires a lot of time, resources, contacts in the start-up ecosystem to have access to a strong deal flow, expertise for deep innovative analysis, expertise about legal aspects of VC investments. Corporations do not always have all those assets in-house.

Moreover, a misalignment of purposes can rise between the financial and strategic department of a large corporations due to the high-risk nature of VC investments. Besides, once the investment done, the gap between conservative mindsets in corporations and agile ones in start-ups may not be profit holder for both.

As CVC is very hard to implement, one may wonder on the way to deal with it.

How ?

Many actors are offering external services to enable corporations to have access to VC abilities for investments.

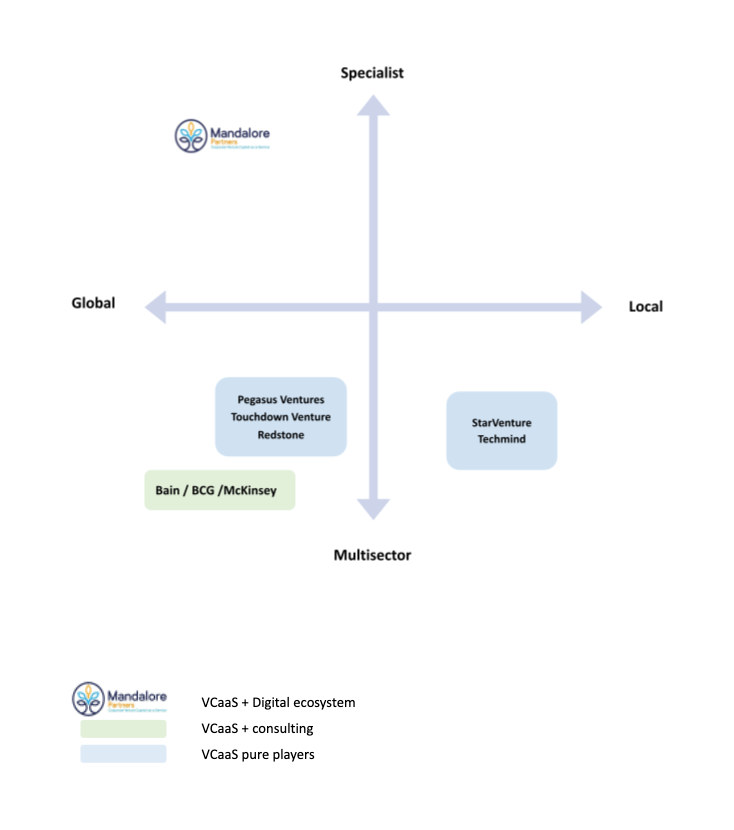

Each actor offers VC-as-a-Service abilities, some are pure players like Touchdown Ventures, some are bringing also a consulting expertise like McKinsey and Mandalore Partners is bringing a Digital Ecosystem along with its VC abilities.

There are three different categories of actors offering VC-as-a-Service abilities.

Pure players like Touchdown Ventures. Among this category, pure players are often multi-sector oriented and operate at a local scale like Techmind or at a global scale like Pegasus Ventures.

Consulting groups like Bain are bringing along their CVC abilities some of their consulting expertise. They operate at a global scale and on many sectors but mostly digital ones (TMT).

Mandalore Partners is a pure player but also brings its Digital Ecosystem along with its VC abilities. Mandalore has a global expertise and is specialized in Insurtech.

What ?

The objective of VC-as-a-Service is to bring VC abilities to corporations and start-ups:

Sourcing is one of the hardest abilities to acquire when a corporation wants to acquire VC skills. Indeed, it requires a lot of time and relations to build an efficient network. Using VC-as-a-Service gives corporations access to top-notch deals. VC-as-a-Service also quickly identify startups that fit within the strategic roadmap of the corporate partners thanks to previous deals and accumulated experiences.

More than Sourcing, VC-as-a-Service also brings a structure and a platform to rely on. Indeed, VC-as-a-Service funds have financial expertise, fine knowledge of the sector and contacts to find the best diligence as possible.

An efficient CVC investment is not finished when the start-up has received the funds from the company. VC-as-a-Service funds also follows the portfolio of the company and helps the start-up in its future milestone.

Using a VC-as-a-Service fund is in fact time saving and cost effective. It only takes few weeks to launch and to follow a CVC strategy for a corporation.

All along the investment process, decisions are made by the corporate which is enlighten by VC-as-a-Service fund. The fund is not making any investment alone.