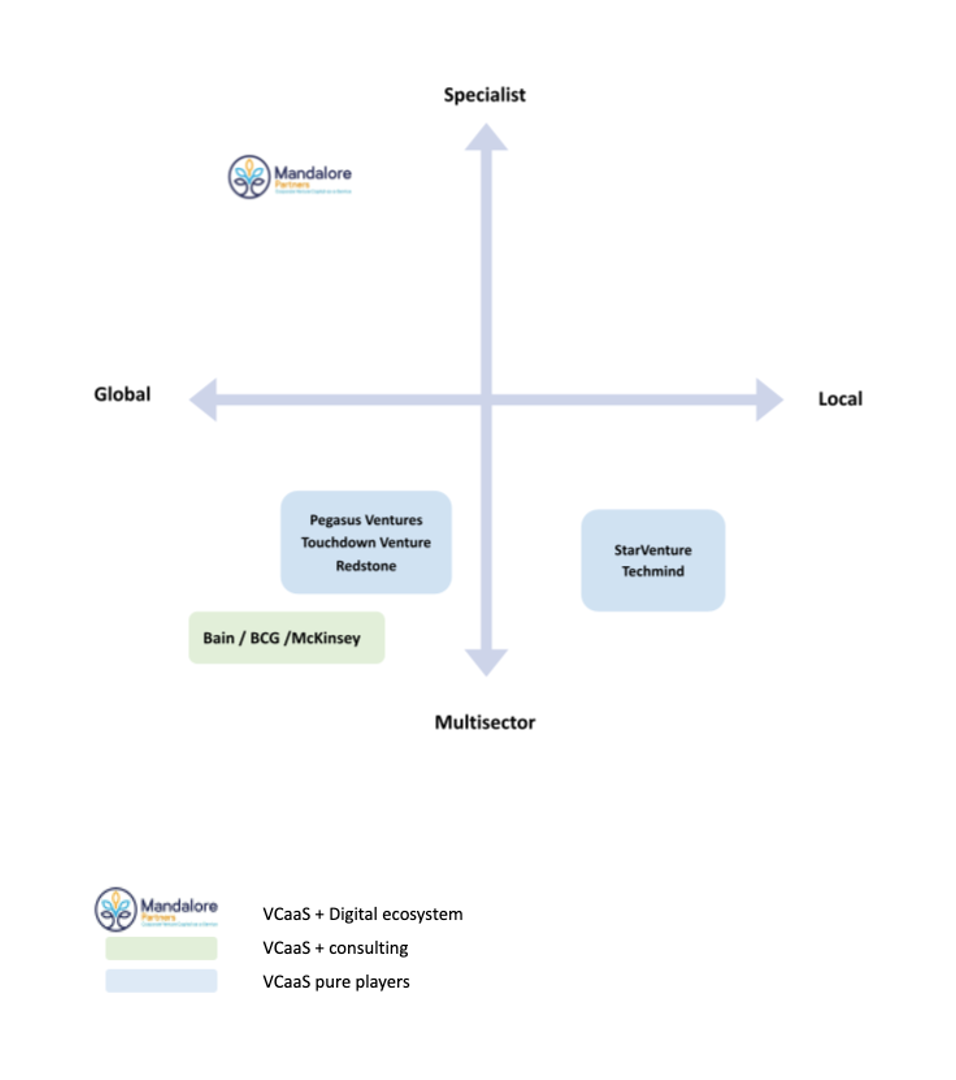

Mandalore Partners shares its view on Web3 and blockchain dynamics in 2022, focusing on mapping decentralized applications. The geographical scope is mainly Europe, North America and Asia.

Economy of Web3

Mandalore holds that the industry of Web3 will transform all economic sectors on a global scale. As a component of Web3, blockchains have the potential to have a greater impact on how we interact with the internet on how many software applications are currently operating their backends. The way we produce and transmit value online is particularly relevant from an economic standpoint. With the chance to have more power and individuality than ever before, creators are in charge right now.

As it can be seen on the following graph, web3 was a subject of growing interest during the 2 last years.

2023 is likely to see other countries moving to position themselves as Web3-friendly – often through the use of central bank digital currencies – such as India's forthcoming e-rupee and China's Digital Yuan. This dynamics is all the more important as it accompanies the development of artificial intelligence, cloud computing, and metaverse – all technologies which are closely related to new developments in Web3. This represents a very opportunity market for a venture capital firm. However for now, the relative cost of transactions is still prohibitive to many. Web3 is less likely to be utilized in less-wealthy, developing nations due to high transaction fees.

What is Web3 ? A decentralized web

Web3 is a decentralized, trustful, and private internet that makes use of blockchain technology. Web3 refers to the next generation of internet technology, which is based on a decentralized infrastructure. This means that no central authority controls or regulates the internet, and users have more control over their data and privacy: we talk about decentralized web. It has several key characteristics that differentiate it from the current internet:

Decentralized

The biggest difference between web3 and the current internet is that web3 is decentralized, whereas the current internet is centralized with still some static websites. This means that there is no central authority controlling or regulating web3, and users have more control over their data and privacy. It remplaces the ancient web by the ability to create open protocols and decentralized, community-run networks, combining the open infrastructure of web1 with the public participation of web2. One of the goals of the Web3 movement is to create a decentralized social networks.

Secure

One of the advantages of decentralization is that it makes the web3 more secure. Since there is no central server or database, it is much harder for hackers to access user data. Also, each user's data is stored on their own computer, so even if a hacker were to gain access to a database, they could only access the data of one person at a time.

Private

Another advantage of decentralization is that it makes the web3 more private. Since there is no central server or database, companies cannot track users' online activity. In addition, each user's data is stored on their own computer, so companies cannot access it without the user's permission.

Permissionless

Everyone has equal access to participate in Web3, and no one gets excluded.

Web3 and Blockchain

The Web3 is built on the blockchain which gives the precedent advantages. This technology is not only used for cryptocurrencies, it is also used to conclude contracts or to control the functioning of applications thanks to smart contracts.

As a reminder, it is a kind of registry that contains a list of all exchanges made between users. This register is decentralized - i.e. stored on the servers of its users - and very secure because it relies on a cryptographic system of validation by the users for each transaction. Hence the name "blockchain". It uses smart contracts that are algorithms that operates on the blockchain. You can find a definition of smart contracts on Binance Academy website: https://academy.binance.com/en/glossary/smart-contract.

In the case of decentralized web, this allows the creation of financial assets, in the form of tokens for example, to ensure the internal functioning of each service. The platforms is therefore operated, owned and improved by communities of users. The idea behind Web3 is that technologies like blockchain , cryptocurrencies, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs) give us the tools we need to create online spaces that we truly own, and even to implement digital democracies.

Each user has his digital identity, creating a record on the blockchain of all their activities. And, for example, each time they post a message, they can earn a token for their contribution, giving them both a way to participate within the platform and a financial asset.

A Web3 Map

Venture Map of Web3

Here is a commentary about the different categories presented.

I. Infrastructure

Developer tools: Developer tools are pieces of decentralized blockchains software like protocols, Layer X solutions, APIs, and SDKs that make it easier for blockchains to communicate with one another and perform more robustly.

Data analytics: Startups in this category provides blockchain data and analytics solutions to their customers.

Security & Privacy: Startups in this category are developing security and privacy solutions on top of existing blockchains

Reg Tech: Companies that provides various regulatory and compliance solutions to the blockchain ecosystem in areas such as tax compliance and anti-money laundering

Entreprise: Startups working on blockchain-based solutions for healthcare institutions across several fields, including life sciences and clinical trials. Some companies offer blockchain-based supply chain solutions to address issues like agricultural traceability and help them with better vision. Some companies provide a range of blockchain technologies geared toward business use cases.

II. Fintech - Decentralized finance

Currencies: Currencies that run on different blockchains. Created largely with the intention of developing better currency for various use cases, these projects represent either a store of value, a medium of exchange, or a unit of account.

Payment: Startups that provide payment services and support cryptocurrency transactions by developing and running cryptocurrency exchanges or by creating cryptocurrency trading applications.

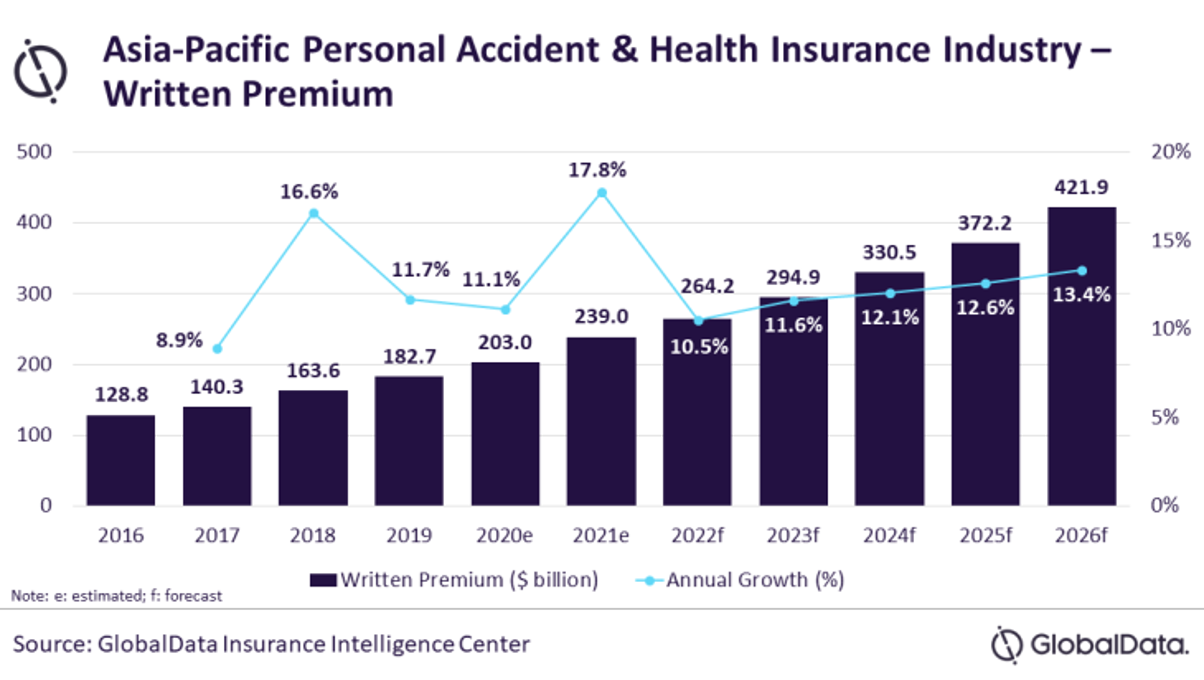

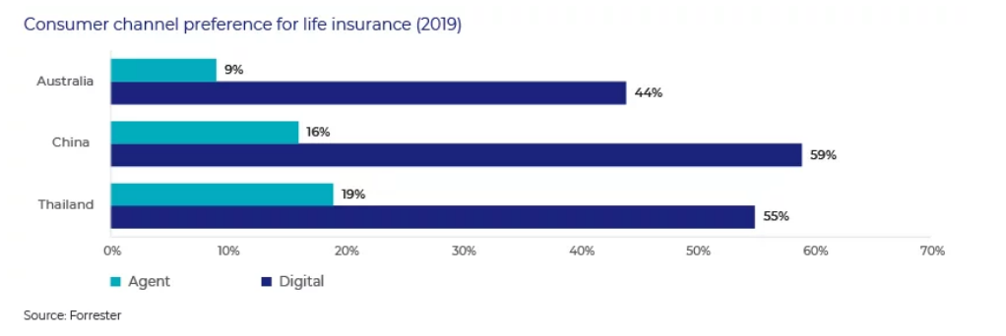

Insurance: Types of Company that provide insurance technology solutions on the promise of innovation. These projects protect against the vulnerabilities of smart contracts or price volatility by raising public funds to use as hedges.

Wallet services: Startups in this category are developing and operating

crypto wallets. It develops of digital asset security infrastructure helping crypto-native and financial institutions to create digital wallets.

III. NFTs

Most people have probably heard of NFTs, it is a transaction stored on the blockchain which corresponds to non fungible tokens, and therefore completely unique. The idea is to be able to use it as a certificate of authenticity associated with a digital or physical object. Each token is unique but obviously players can have ownership of tokens on different platforms. Among these projects, different types of tokens exist, such as governance tokens, equity tokens, security tokens, or utility tokens.

Gaming: NFT technology is being incorporated into video games by startups in this sector, opening up new business models like play-to-earn. The main contribution of the blockchain for users and players is the "play to earn": each player can play and indulge his passion by earning crypto-currencies. This model appeared with the birth of NFT, these certificates that allow to attest the authenticity of a digital object and therefore to own them, then to resell them. The decentralization brought by the blockchain (no central regulating entity) causes a potential paradigm shift: players no longer pay a license or subscription to play, but invest in the game to obtain tokens and develop, and then earn money from these benefits. Purchased NFTs bring decision-making power, which can take many forms and is independent of the publisher, and bring a gain.

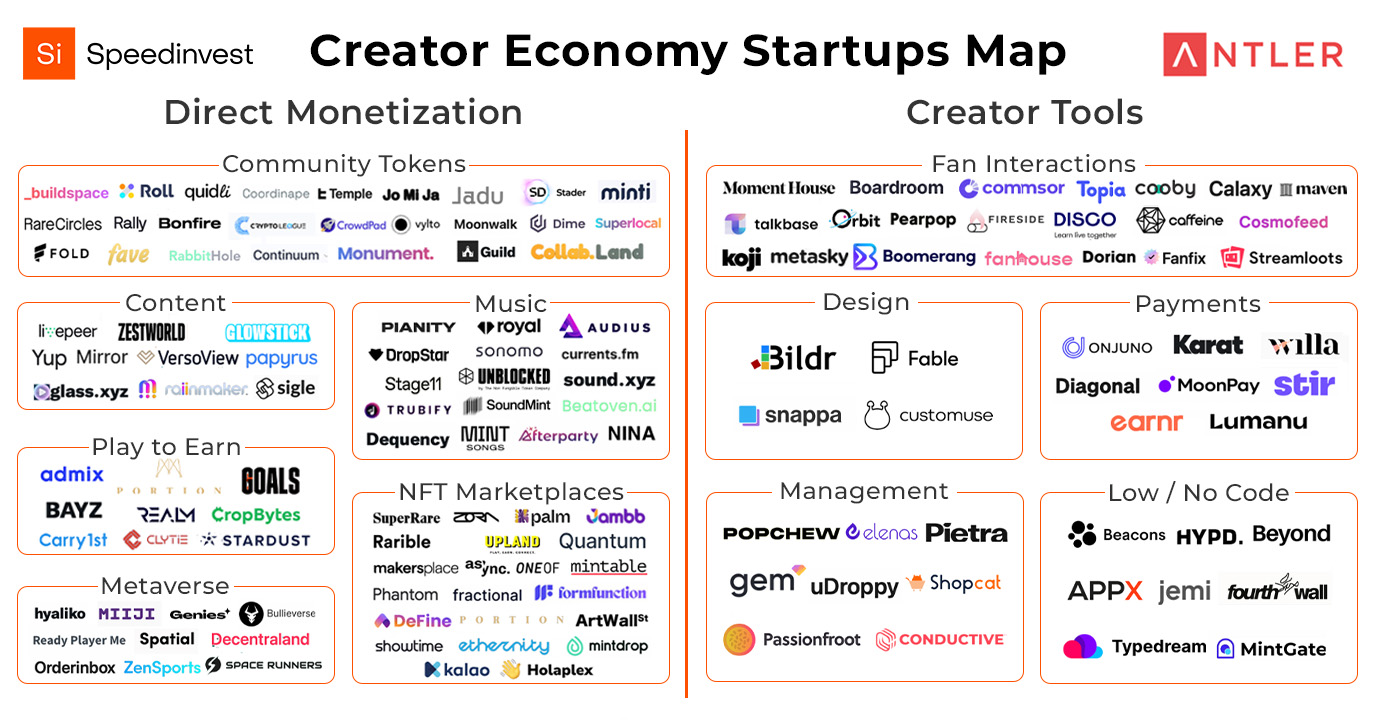

Marketplace: Types of company that are developing and operating exchanges meant to help mint and trade NFTs on different platforms, for very various way of use (art, music,...)

Community: Examples of social media platforms designed for team collaboration, program management and member tracking. Interact with fans on a whole new level through easy to access channels where they can post commentary, fan art,...

Metaverse: The metaverse (contraction of "meta" and "universe", i.e. meta-universe) is a network of always-on virtual environments in which many people can interact with each other and with these digital objects while operating virtual representations - or avatars - of themselves. Corporations in this category are developing NFT experiences

related to the evolving metaverse.

Please find below the different maps on the web3 market that helped us build ours:

Web3 market map from TechCrunch

TechCrunch Web3 Map

Web3 market map from Coinbase

Coinbase Web3 Map

Web3 market map from Crunchbase

Crunchbase Web3 Map

Web3 market map from SPEEDINVEST

Speedinvest Web3 Map

You can find more information on our commitment to Web3 activities on our website: https://www.mandalorepartners.com/web3surance

Feel free to contact us to discuss a partnership or for more information about this article.

Minh Q. Tran, minh@mandalorepartners.com