Insurance in Asia has extremely high growth potential…

Insurtech and insurance in general has extremely high growth prospects in the region, much more so than in other more mature markets like Europe.

Over 40% of the middle class population in Southeast Asia is uninsured: the scope of penetration for digitally charged insurance businesses through technology mediums like smartphones is huge. As standards of living rise and health concerns (for example linked to the pandemic) remain a preponderant issue, we expect demand for insurance products to increase. Penetration rates for Asia-Pacific stood at 3.8% for life insurance and 2.1% for non-life insurance in 2018, considerably lower than in the UK and the US that reported rates of over 10%. Insurance company Swiss Re estimates that by 2029, 42% of gross insurance premiums would originate from Asia-Pacific, with China accounting for 20% of this. Asian consumers are increasingly looking at insurance not just as a protection but also as an investment option.

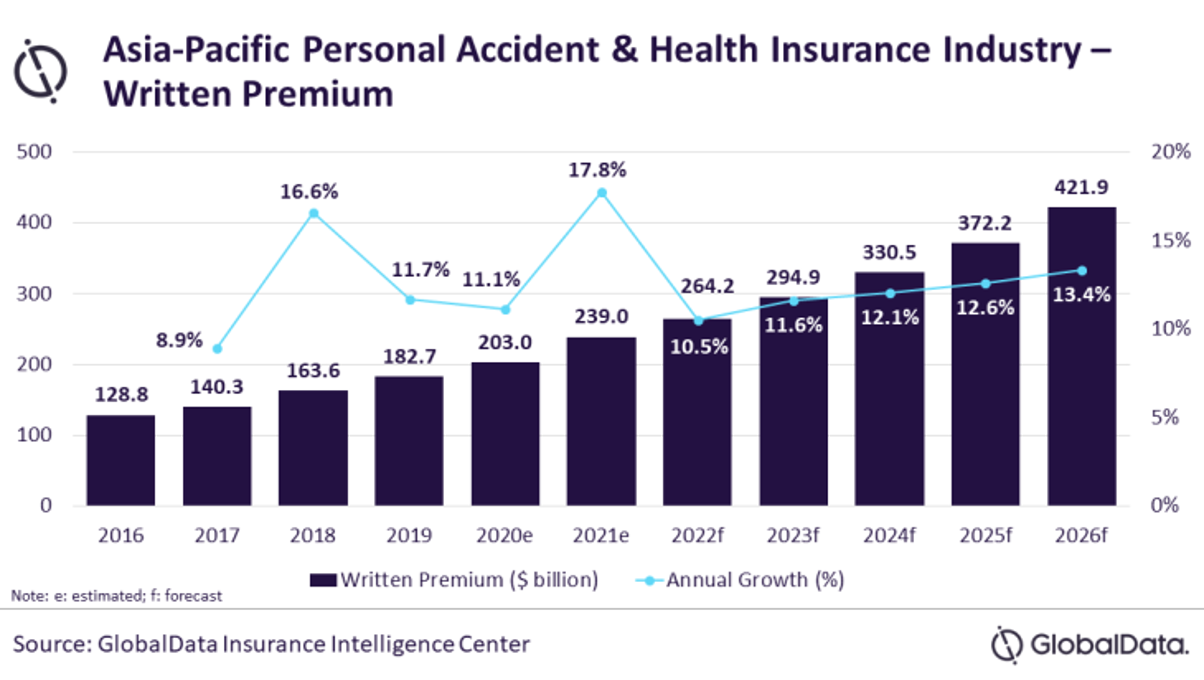

This is likely to lead to significant revenue growth for actors in this industry, as shown above by the projection of the evolution of premiums in the coming years.

….providing a unique opportunity for the development of insurtechs…

According to McKinsey, insurance companies in Asia are therefore very aggressive in terms of growth prospects, and insurtech can be a key way to rapidly reach under-served consumers.

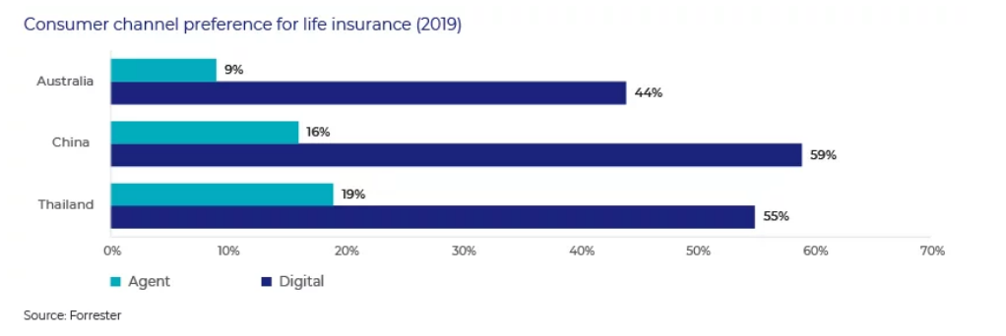

The key point is that while there is a very large potential for growth, it may not be best served by traditional insurers. As shown above, customers now prefer digital solutions. This is where insurtechs can play a major role.

Indeed, VC funding in the sector has reached large levels in recent years. Venture capital has also recognized the potential profits to be made from digitally disrupting insurance. According to a paper by Bain, in the past five years, venture capital firms have invested about $3.8 billion in Asia-Pacific insurtechs, including online sites that sell directly to the public, online brokers and advisers, and aggregators or digital marketplaces.

According to the report, in fast-growing markets such as mainland China, India and Indonesia, insurtechs can “leapfrog” incumbents and gain market share. Digital marketplaces, which allow customers to easily compare and select policies from competing carriers, may be able to conquer a significant share of the insurance profit pool. In major markets around the world, a majority of retail insurance customers—especially young, digitally active ones—are open to switching to another provider, including companies from outside the industry, such as retailers, automakers or tech firms, according to Bain & Company’s fourth global survey of more than 174,000 customers in 18 countries (“Customer Behavior and Loyalty in Insurance: Global Edition 2018”). Asia-Pacific insurance consumers are very receptive to new ideas and new players. In Thailand, Indonesia, mainland China and Malaysia, for example, more than 85% are open to buying from new entrants, according to Bain’s survey.

…which for now remain concentrated in mainland China, Hong Kong and other East Asian countries. However a key trend for coming years will be the emergence of new markets

Banks in financial hubs of SouthAsia, Singapore, and Hong Kong have already received significant investments in Insurtech: For example, DBS bank from Manulife of 1.2 Billion dollars, Citibank from AIA group 800 Million dollars and Standard Charted from Prudential 1.25 Billion dollars.

Singapore and Hongkong are providing a wide range of development and growth options like incubators, insurance labs and more for startups in the insurtech sector.

Examples of insurtech startups from around the region

As shown above, a number of high potential ventures have developed around the region. For instance, China is also seeking to build up big online platforms to provide various insurance options personal, medical, auto online. Malaysia has already started reaping the benefits of such platforms by slowly reducing the need for live agents.

Nonetheless, other markets are also seeing the development of insurtechs. For example, insurtech funding in India has increased from only 11 million USD in 2016 to 287 million in 2020, with startups such as Turtlemint which raised 30 million in late 2020.

Insurtech can help the sector remove obstacles to growth…

According to McKinsey, Asian insurers currently tend to suffer from three main weaknesses:

Sales force professionalization. The entire US insurance industry, as one example, has a few hundred thousand agents. Agency forces in Asia are significantly larger—China alone has roughly eight million insurance agents. However, the level of professionalization in Asia lags behind the developed world. Part-time and poorly trained agents are the norm in much of Asia. As customers continue to grow more sophisticated, Asian carriers will have to upgrade their agency forces. They can learn much from the West in terms of recruiting, capability building, and ongoing performance- and compliance-management. Western carriers are now helping agents migrate from product sellers to holistic advisors which provides a blueprint for Asia.

Analytics-driven decision making. The West is increasingly applying data and analytics in all elements of the business to improve the quality and consistency of decision making. In some cases, this has progressed to rely extensively on third-party data. In Asia, the use of data and analytics is less mature. Carriers need to invest in their internal data assets (i.e., capturing and storing more useful data), external third-party data integration, advanced analytics capabilities, and “last mile” adoption of analytics solutions. There is tremendous opportunity for carriers in all elements of the value chain, including pricing and underwriting, sales force effectiveness, customer servicing, and claims. Given the distributed nature of insurance operations in Asia and the talent gap, this is an even bigger opportunity.

Operational discipline and efficiency. Asian carriers can learn from the operational discipline of insurers in developed markets. Faced with the prospect of slower growth, Western insurers have long focused on improving efficiency through more optimized operations. Asian executives have underinvested in operational discipline and efficiency. It is not uncommon to find dozens of branches or field offices with widely varying operating practices. This increases costs, delivers suboptimal customer experience, and introduces significant compliance risk. Asian carriers will have to focus more time and investment on these issues in the near future. They can benefit from the new toolbox that has emerged which combines digital, analytics, robotics, and NLP to re-invent customer and back office journeys.

… and artificial intelligence is a key driver of change

The advancement of Artificial Intelligence (A.I) allows for much faster understanding of this data. This empowers intermediaries and underwriters to engage clients knowledgeable with data driven policy advice in real time.

Customers want to connect with insurers from virtually anywhere and at any time. The employment of AI processing will soon permeate almost every facet of the insurance business. For example, the insurer QBE Asia has “started seeing benefits from integrated AI systems that streamline and automate our claims workflow and reduce costs by consolidating the underwriting processes on a centralized platform”. They also deploy Robotic Process Automation to save significant costs on repetitive non-value adding tasks and have started to actively integrate connected devices (Internet of Things, IoT) into their insurance processes.

Finally, public authorities are likely to modify and adapt regulations in reaction to the development of digital insurance and insurtechs

According to Bain, “digital disruption is getting a push from regulators. In Singapore, Hong Kong and, more recently, Indonesia, authorities are actively promoting digital innovation and have established government funded incubators, known locally as sandboxes, to encourage insurers to experiment with new technologies”. Singapore and Hong Kong are emerging as hubs for telematics and insurtechs, and consumer use of digital channels in those markets is growing rapidly. This means new regulations are likely to be put in place, and insurtechs should prepare for this risk.

Sources:

What’s hot in InsurTech in Asia Pacific?

Growth of InsurTech in Southeast Asia - Mantra Labs

Insurance in Asia and the West – what can each market learn from the other?

How InsurTech Is Shaping The APAC Insurance Market

Asia – Set to become a big market contributing to global insurtech growth

Spotlight Asia: The Future of Insurtech in Southeast Asia | The Fintech Times

https://www.bain.com/insights/making-the-most-of-asia-pacifics-insurance-boom/

https://www.asiainsurancereview.com/Magazine/ReadMagazineArticle?aid=44573

https://techcollectivesea.com/2022/04/15/insurtech-southeast-asia/