The European insurance landscape stands at a fascinating crossroads. While traditional players have dominated for centuries, a new wave of technological innovation is reshaping the very foundations of how insurance operates. The question isn't whether disruption is possible, it's whether incumbents will adapt fast enough to survive the transformation already underway.

The Digital Revolution is Just Beginning

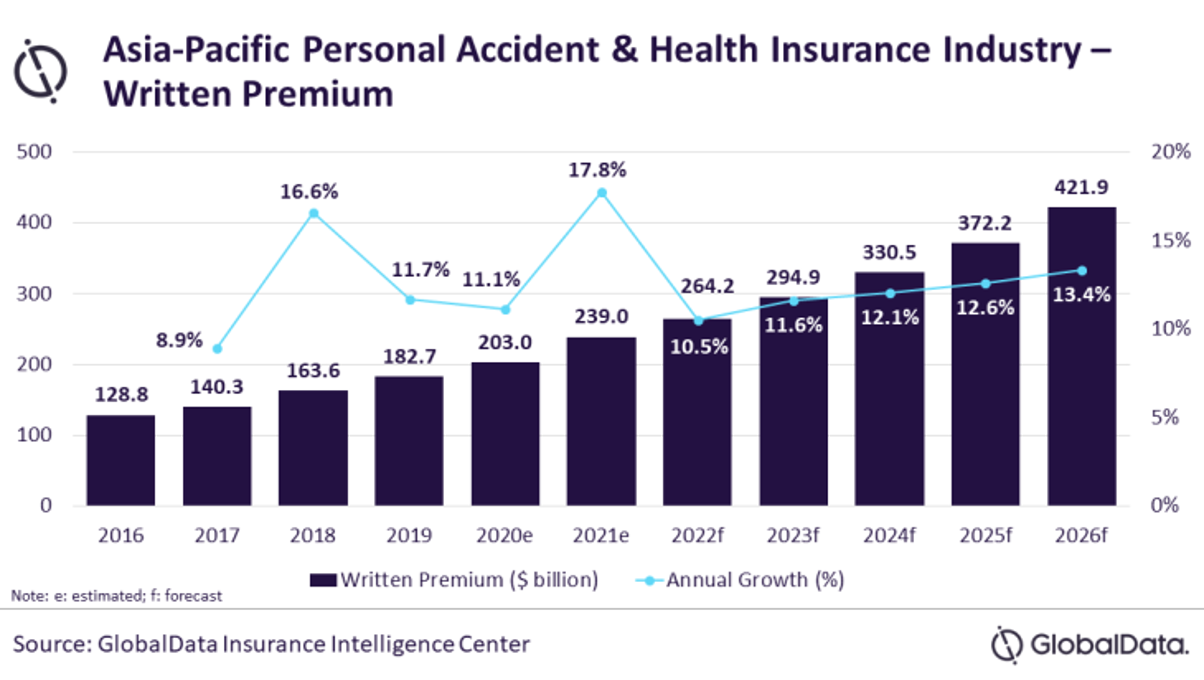

The numbers tell a compelling story. The insurance technology market size in Europe is estimated to grow by USD 19.72 billion from 2024-2028, according to Technavio, with the market estimated to grow at a CAGR of almost 36.5% during the forecast period. This explosive growth signals that we're witnessing the early stages of a technological revolution, not its conclusion.

What makes this particularly striking is the stark contrast with traditional growth patterns. While the broader European insurance market maintains steady single-digit growth, insurtech is expanding at rates that would make Silicon Valley envious. This disparity reveals massive opportunities for companies willing to embrace digital-first approaches.

Where Traditional Models Show Vulnerability

European insurance has historically relied on intermediaries, complex underwriting processes, and lengthy claim settlements. These legacy systems create friction points that modern consumers increasingly refuse to tolerate. Consider the average home insurance claim in Germany, which can take 30-45 days to process through traditional channels, compared to digital-first insurers who promise resolution within 48 hours.

The protection gap presents another compelling opportunity. Climate change has created new risks that traditional models struggle to assess and price accurately. The insurance industry is transforming, driven by new tech, tax laws, and expectations, yet many European insurers remain reactive rather than proactive in addressing emerging risks like cyber threats and extreme weather events.

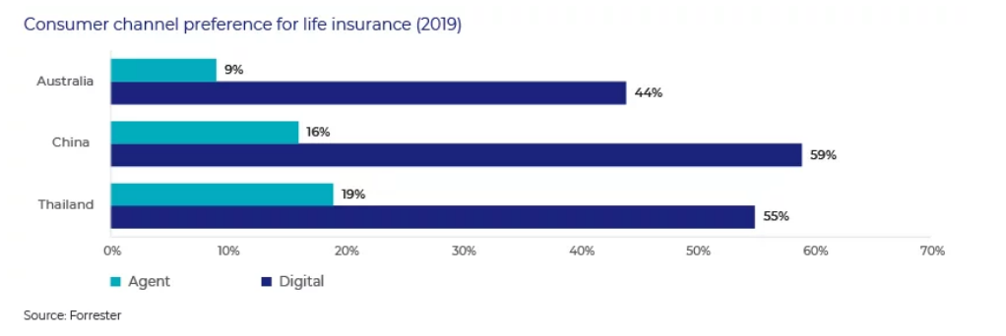

Young Europeans represent perhaps the largest untapped market. Digital natives aged 25-35 show significantly lower insurance penetration rates than previous generations at the same age, not because they don't need coverage, but because existing products don't align with their lifestyle and expectations. They demand instant quotes, transparent pricing, and seamless mobile experiences, areas where traditional insurers often fall short.

Successful Disruption Models Already Emerging

Several European companies have proven that disruption isn't just possible, it's profitable. Lemonade, while originally American, has successfully expanded into European markets by offering renters and homeowners insurance through an AI-powered platform that can process claims in seconds rather than weeks.

Sweden's Hedvig has revolutionized home and contents insurance by eliminating deductibles and offering transparent, flat-rate pricing. Their model shows how removing traditional insurance complexity can attract younger demographics who previously avoided coverage altogether.

In the UK, Zego has transformed commercial vehicle insurance by providing flexible, pay-as-you-go coverage for delivery drivers and ride-share operators. This micro-insurance model addresses the gig economy's unique needs, a market segment traditional insurers largely ignored.

Technology as the Great Enabler

Artificial intelligence and machine learning have matured to the point where they can now handle tasks that previously required human expertise. Modern AI can analyze satellite imagery to assess property damage, process natural language to understand claim descriptions, and detect fraud patterns with greater accuracy than human investigators.

IoT devices create unprecedented data streams that enable real-time risk assessment. A smart home system can prevent water damage by automatically shutting off pipes when leaks are detected, then instantly notify insurers to update coverage terms. This shift from reactive claim processing to proactive risk prevention represents a fundamental business model transformation.

Blockchain technology, while still emerging, promises to streamline multi-party insurance transactions and create tamper-proof claim histories. European regulatory frameworks like GDPR actually position the region well for blockchain adoption, as the technology aligns with data sovereignty requirements.

Regulatory Environment Creates Opportunities

European insurance regulation, often viewed as constraining innovation, actually creates moats for disruptors who can navigate compliance effectively. Solvency II requirements, while complex, establish trust frameworks that tech-savvy companies can leverage more efficiently than traditional insurers burdened by legacy systems.

The EU's Digital Single Market strategy actively encourages cross-border insurance innovation, making it easier for successful models to scale across the continent. This regulatory support contrasts sharply with the fragmented approach in other regions, giving European disruptors a significant advantage.

Open Banking regulations have also created precedents for data sharing that could extend to insurance. When customers can seamlessly share their financial and behavioral data with insurers, it enables more accurate risk assessment and personalized pricing, core advantages for innovative players.

The Path Forward

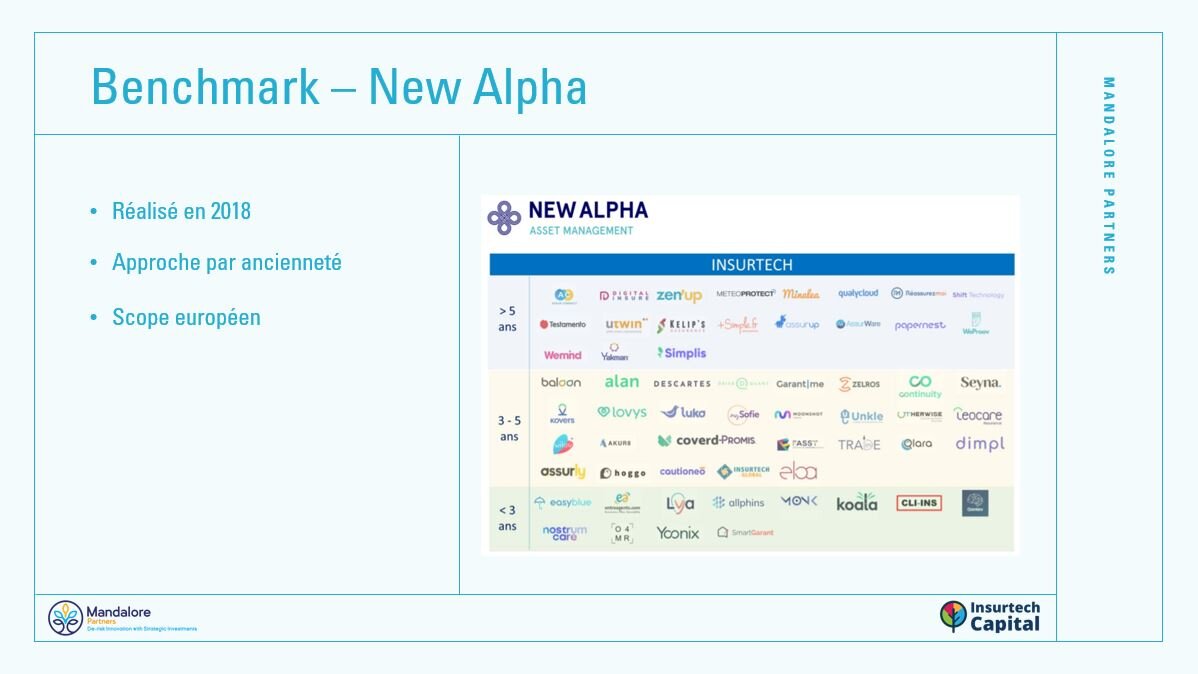

The European insurance market isn't just ripe for disruption, it's demanding it. Consumer expectations, technological capabilities, and regulatory frameworks have aligned to create an environment where innovative approaches can thrive. While investments in insurtech saw both deal volume and funding decline in 2023, this consolidation phase often precedes breakthrough innovations as the strongest players emerge.

The companies that will define the next decade won't be those trying to digitize existing processes, but those reimagining insurance from first principles. They'll use data to predict and prevent losses rather than just compensate for them. They'll create products that adapt to individual lifestyles rather than forcing customers into standardized categories. Most importantly, they'll build trust through transparency and speed rather than complexity and tradition.

The question facing European insurance isn't whether disruption will continue, it's whether established players will lead the transformation or be swept aside by it. For entrepreneurs and innovators, the answer is clear: the opportunities have never been greater, and the time to act is now.