There are many benefits the venture capital as a service model can provide. First, it allows you to access leading-edge thinking and high-growth potential innovations and to build relationships with tech-led businesses that can be directly deployed by the corporation. Second, it allows you to generate a financial return for the corporation. Third, it allows you to access venture capital thinking and expertise to inform your own corporate strategy. Finally, it helps you minimize surprises from an impact and financial returns viewpoint.

There are also some risks associated with venture capital as a service. First, if you are not careful, it can lead to a conflict of interest between the corporation and the venture capital firm. Second, it can be difficult to find a venture capital firm that is a good fit for your corporation. Third, the venture capital firm may not be able to generate the expected return on investment. Finally, the venture capital firm may not be able to provide the desired level of service.

The three models of Venture Capital funding

There are a few models currently deployed by organizations when it comes to venture capital funding that also leverage a corporation.

Firstly, corporations can choose to directly manage their Corporate Venture Fund or Do It Themselves. This has been the more “traditional” strategy, initially adopted by most major actors, from Google to Axa. It entails significant commitments, in terms of both financial, human, and organizational resources: internal teams and processes have to be set up from scratch, and venture money has to be actively monitored and managed. Our Venture capitalists’ service enables our clients to tailor very specific tech investment thesis and secure their operations with minimum resource involvement to accessing qualified deal flow as well as expensive and sophisticated back-office resources.

Secondly, there is capital investment in independent venture capital funds. This more passive venture capital funding approach requires less corporate commitment and resources, but it also leads to minimal mandate control, limited co-investing opportunities, a closed-end fund structure, and no investment committee participation.

We can clearly see there are advantages and significant downsides to both of these approaches. This is why there is now a more active and strategic alternative participative funding option.

As a financially optimized model, Venture Capital as a Service (VCaaS) can be a fully outsourced service, or it can be a platform providing organizations with the opportunity to complement existing or build new, in-house venture capitalist capabilities. VCaaS delivers financial and strategic returns, as well as scale, context, and focus for corporates, government organizations & family offices.

What are good examples of venture Capital Funds?

Multiple major corporations have put in place a comprehensive venture capital strategy in the past few years. As noted above both Touchdown Ventures and Pegasus Tech Ventures are well known in the nonfinance sector with respectively 63 and 175 portfolio companies.

The ultimate goal is to accelerate the success of portfolio companies by connecting them to networks of multinational corporate partners to create opportunities for business development, manufacturing, distribution, and global expansion. Some of the core capabilities these corporate venture capitalist arms have bespoke and industrialized for corporations include:

Distribution deals focus on using existing and new social channels to bring new products and services to customers.

Co-marketing typically involves bundling corporate and startup product messages to potential customers who would be interested in the joint offer.

Vendor agreement structuring where one party buys from another. Corporations can purchase products or services from startups, or startups can buy from corporations too.

Supply chain collaborations generally allow startups to leverage the scale, experience, and relationships of larger corporations.

Licensing transactions can focus on sharing technology know-how, patents, or other forms of intellectual property, including content.

The insurance industry has also been dynamic with a few leading re/insurers leading the pack. Still much more can be done in the sector.

AXA Venture Partners

With $1 billion of assets under management. Axa Venture Partners has been one of the pioneers of corporate venture capital in Europe, launching AXA Venture Partners in 2015 with a focus on seed and early-stage funding opportunities in Europe, US and Canada, Israel, and the Mena region. Unicorns include Blockstream and Phenom.

MunichRe Ventures

Launched in 2015, Munich Re Ventures is an extremely active and respected corporate venture fund that counts seven unicorns, 2 IPOs, and 5 acquisitions. The fund has taken a diversified portfolio approach investing in tech companies in finance, insurance, enterprise technology, transport and logistics, aerospace, and environment tech among the few.

Generali and Inco Ventures:

Designed in partnership with INCO Ventures, a pioneer in impact investing, Generali launched in November 2020 the Generali Impact Investment fund. Reserved for institutional investors, this fund aims to financially support the growth of companies and organizations that contribute to improving the lives of the most vulnerable families and the professional integration of refugees. Generali France has thus taken a new step in its responsible investment strategy, in favor of more inclusive and more sustainable savings. The fund is committed for 20 years to an ambitious approach to Corporate Social Responsibility.

Most corporations do not have one single fund. To diversify portfolio strategy and ensure that they cover a variety of aspects across their value chains, they seek expertise from a variety of venture capitalists and startup commercialization experts.

Why should corporations outsource their Venture Capital arm?

In the 1980s and ’90s, many U.S.-based companies outsourced their research and development activities to Asia to reduce costs and secure the technical talent required to meet the growing demand for new digital products and services. With new remote working demands and talent scarcity, there is a need to access structure competence more readily within countries. Diversifying the talent pool has helped American companies to hedge risk and remain innovative. Overall, these U.S.-based companies performed better and drove higher profit margins, often leading the world across a variety of sectors.

The innovative models

A few VC firms have developed innovative models such as venture-capital as-a-service (VCaaS) as a way to support corporates to modernize and industrialize their innovation activities. They help corporations manage their corporate venture capital funds and find the most innovative startups to invest in, based on their interest areas. The firms also help facilitate startup relationships, developing business and technology collaboration. In many cases, corporations learn about new technology trends, new business models, and best practices from these startups–helping the corporations remain innovative. Startups in this model benefit from access to decision-makers, business guidance, and potentially a new revenue stream.

A venture capital firm: Innotech Corporation

As one of the best-funded venture-backed companies, and a smart automation provider, Osaro, successfully leveraged the opportunities offered by VCaaS and received funding from Innotech Corporation.

Partnering with Innotech Corporation and Pegasus Tech Ventures has been critical for our international business expansion as well as for funding across multiple rounds of financing. We look forward to continuing our growth together and highly recommend that fellow entrepreneurs establish similar win-win relationships between investors and corporations.

Derik Pridmore, CEO of Osaro.

Indeed, startups often lack the scale, expertise, and experience needed to quickly grow to new markets and segments. As emphasized by Venturebeat, this makes effective partnerships with experienced corporations all the more important:

As our world becomes more connected than ever, it has become easier for startups to expand their businesses into fast-growing markets abroad. Yet, in many circumstances they still need the right partner in order to do so.

Venture capitalists outsource corporate innovation

Outsourcing corporate innovation using VCaaS is a new way to address the ever-growing need of corporates to reinvent their business models. The approach relies on the expertise of angel investors, institutional investors, and corporate investors instead of relying solely on internal resources. VC firms that operate using this model are coming up with creative and flexible strategies that allow any corporation (large or small) to take advantage of corporate venturing thinking and invest in innovation. Outsourcing the investor’s expertise allows companies to run and grow their corporate venturing programs, generating top-tier results while keeping costs under control.

To sum up, both corporate firms and startups benefit from a VCaaS configuration. It’s a win-win framework for both sides as commercial engagements and decision-making are de-risked for all parties.

De-risking corporate innovation

There are two ways we look at de-risking the corporate venture capitalist conundrum.

For corporations:

The framework allows for quick access to the VC’s network and deal-flow without having to start from scratch. It also eases access to a less expensive solution to in-house R&D to find new technologies and products. Working with the right venture capital firms, corporations benefit from an all-in-one solution with a competitive management fee–all for a fraction of the cost of typical R&D programs.

Corporates can also an innovation strategy without being hindered by the inertia and bureaucracy that is often present in very large firms.

For startups:

The framework also facilitates easy access to long-term partnerships with established actors in their market. Indeed, the latter entails collaborations with firms that can help corporations quickly enter new markets and offers a potential new avenue to achieve a successful exit (e.g by being acquired by the corporation for instance.)

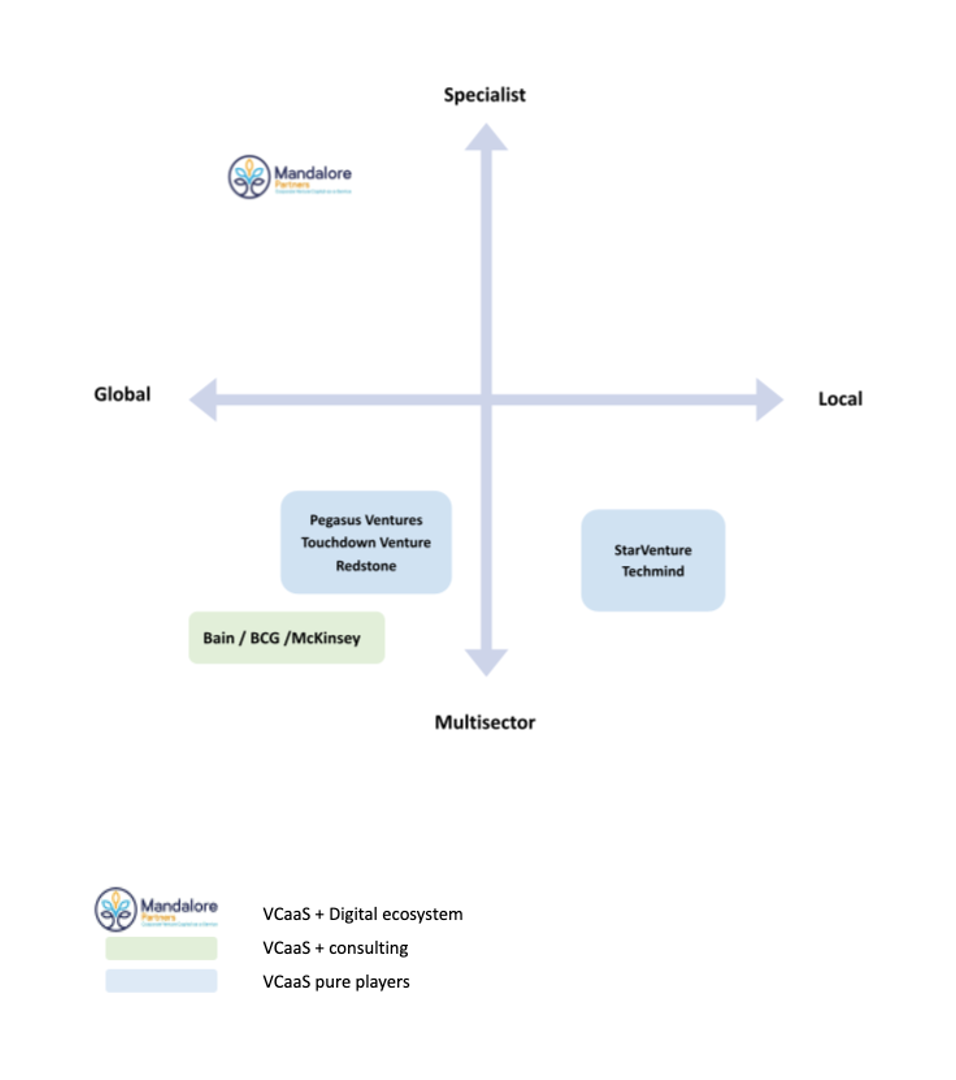

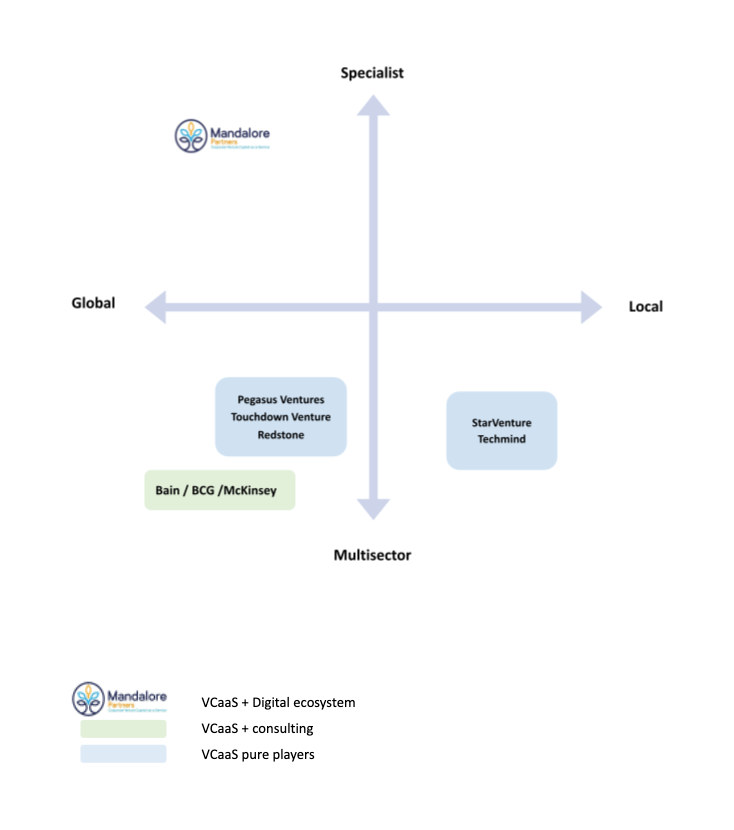

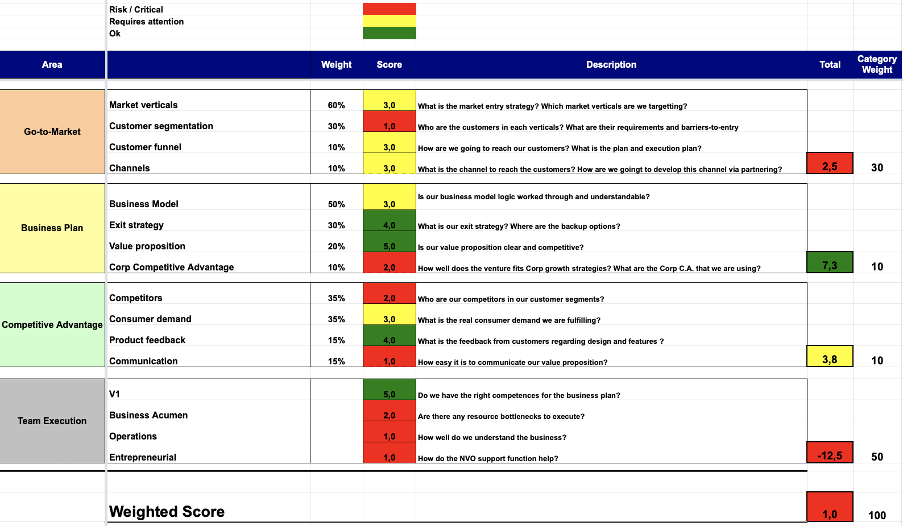

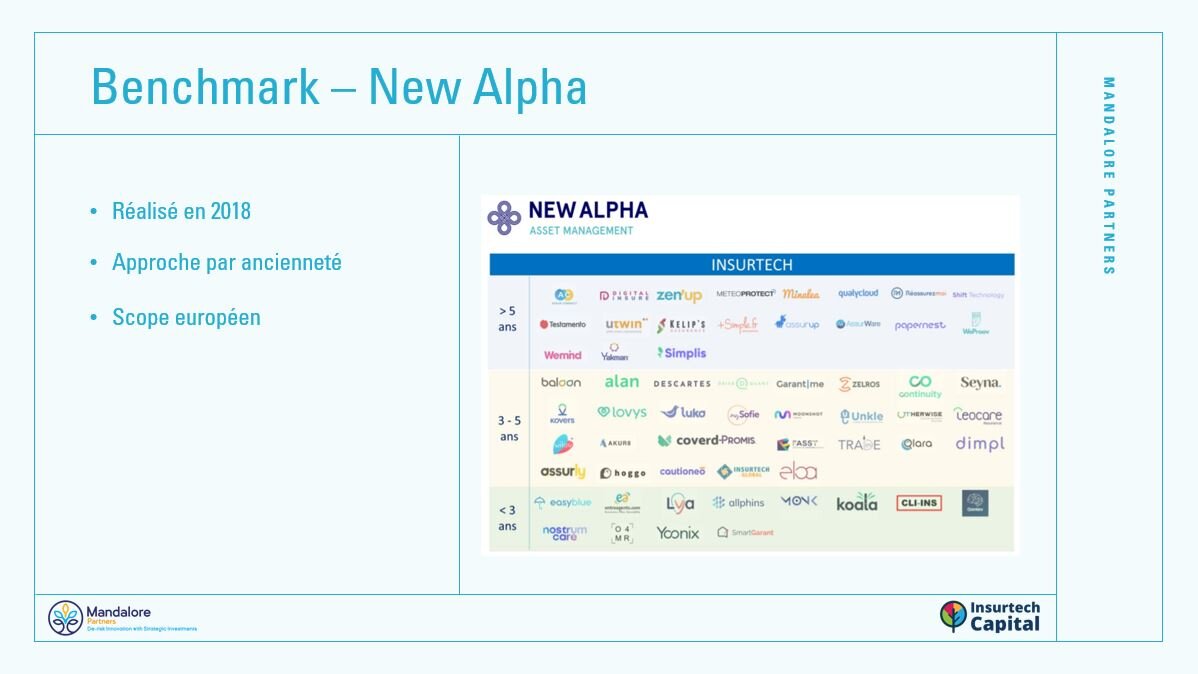

A young but growing practice

While VCaaS is a young, still fast-growing practice, several actors have already built a strong reputation and track record. As noted before, two of the well-established venture capital firms enabling corporate venturing include Pegasus Tech Ventures in Silicon Valley and Touchdown Ventures in Los Angeles. This means partnering with leading global corporations from Kellog’s to T-Mobile with clear gaps across their innovation value chain and supporting them in shaping and scaling activities enabling them to achieve their long-term goals. Similarly, Mandalore Partners, based in Paris, is working with leading insurance firms to help them put in place their venture capital investment thesis to start to benefit from the strategic and financial returns resulting from well-structured VCas a Service funds. From ideation to exits, we provide access to the resources and expertise you need to build a successful venture portfolio.

Roadmap for success

For us, success comes from quickly identifying growth ventures that fit within the strategic roadmap of corporate partners. After the VC introduces corporations to top emerging entrants, they work together to create joint development and revenue opportunities. Partnerships like this are mutually beneficial, leading to corporate innovation initiatives and helping startups scale their business faster.

VC money can drive many opportunities. What if you don’t have the time or resources to source and diligence these deals? Maybe you’re an entrepreneur who wants to raise money for your startup but doesn’t know where to start. Or maybe you’re an established business that needs access to future lens innovative thinking and wants to tap into the startup ecosystem but doesn’t have the know-how. This is where VC as a service comes in. We are a new breed of VC that provides not just capital, but also expertise, resources, and networks to help future-focused corporations and growth ventures succeed. Let’s not just write cheques. Let’s write success stories.

Don’t forget to listen to…

Sabine and I discussed VC as a Service recently on her podcast #scoutingforgrowth. You can find the discussion and episode just here.